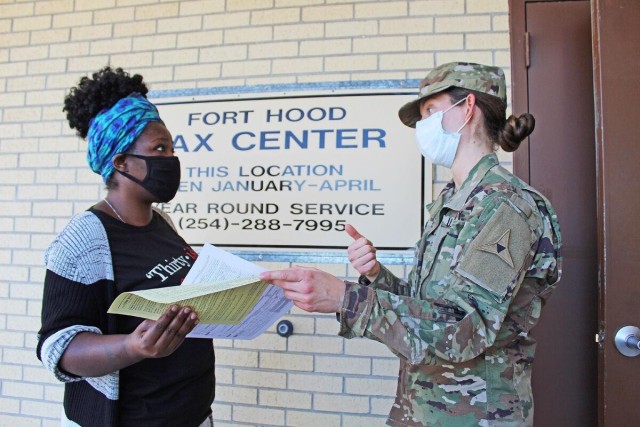

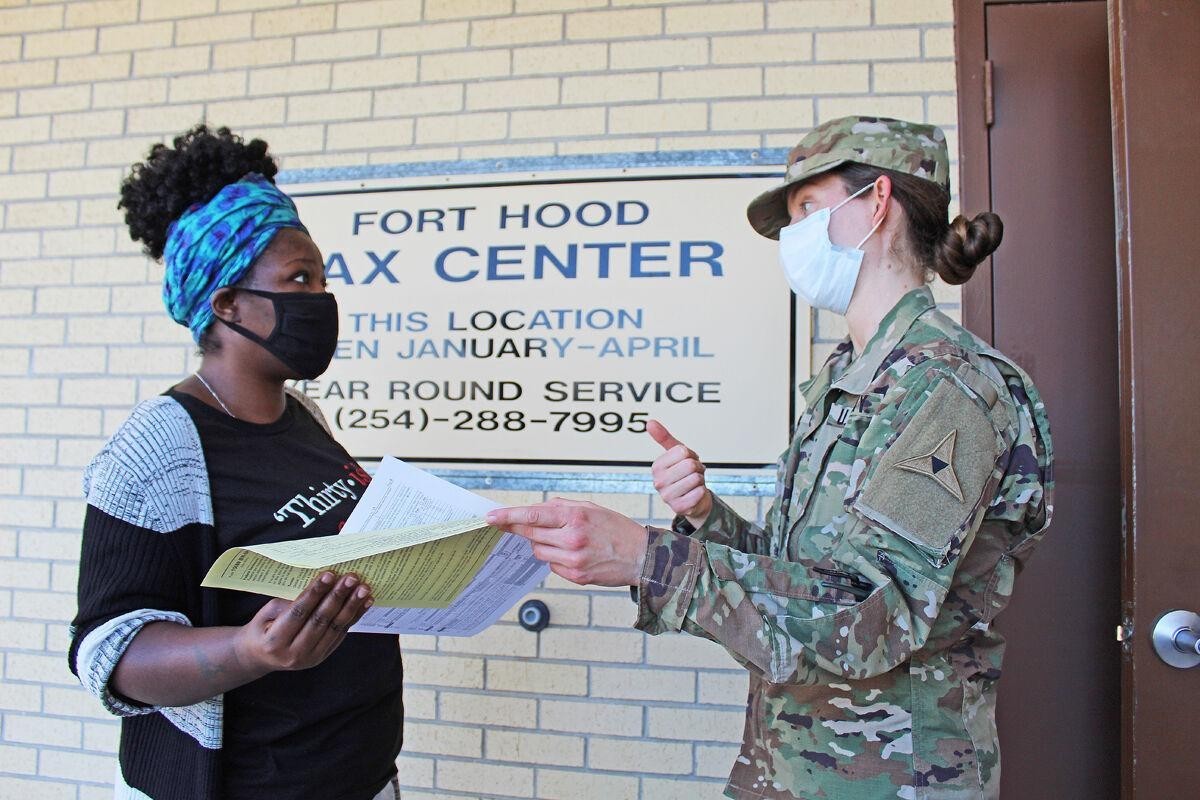

FORT HOOD, Texas -- It is tax time – often seen as the most dreaded time of year – but the Fort Hood Tax Center is hoping to alleviate some of the worry and strife of taxes for the Soldiers, families and retirees at the Great Place.

“I’d like to look at my time here like, ‘How can we make this very big, scary thing, seem very accessible to people?’” 1st Lt. Meghan Moore, the FHTC office-in-charge, explained.

The FHTC prepares returns for thousands of Soldiers, retirees and family members annually, free of charge. While normal tax professionals are certified in basic or advanced tax preparation, the Fort Hood tax professionals are also certified in military tax preparation. Military tax preparation has specific issues, such as non-taxable deployment pay, that requires special attention.

In 2020, the FHTC prepared 2,600 federal and state returns totaling approximately $6 million and saving Fort Hood families $708,000 in tax preparation fees.

The 15 Soldiers who volunteered, or were tasked, with preparing tax returns this year had to first complete tax preparation training provided virtually by tax attorneys with Clark Hill Strasburger Law Firm. While the training is normally conducted in person, virtual training was conducted to alleviate some of the worries regarding the spread of COVID. Moore said the training involves a step-by-step explanation of every form they could use.

“Some people are scared when they hear the word ‘tax,’ so she (tax attorney) goes through every form and explains them,” Moore explained. “It’s been really helpful. I have learned so much.”

She said the virtual training also explains how the Coronavirus Aid, Relief, and Economic Security Act affects taxes. For example, charitable contributions are normally limited to 60% of an individual’s adjusted gross income. Under the CARES Act, individuals can claim up to 100% of their AGI for charitable contributions.

“In terms of COVID and the CARES Act, there’s a lot of information that people don’t know,” Moore added.

To reduce the spread of the virus, appointments are encouraged. Preventive measures have been put into place to ensure the safety of the tax preparers and clients. Moore said that clients are asked to leave all their paperwork with the tax preparer, who will call them when done, so they can sign the return and receive their paperwork back. She described this way of conducting business as having both pros and cons.

“Pros being we can probably spend more time with your packet and just going over it from a quality control perspective,” she added. “Con being that we miss the people and the interface aspect.”

As COVID mitigations increase or decrease across the installation, there could be changes to the FHTC throughout the season.

Clients need to bring with them a copy of their military identification, driver’s license, Social Security card for every family member, all income documents, such as W2s, 1099s, interest income from banking, miscellaneous income, child care expense receipts, college 1098-Ts, rental property information, banking information for the refund to be deposited into and a copy of last year’s tax return.

If the Soldier or spouse is unavailable, a power of attorney is required. Moore said the POA needs to be very specific, to include the exact purpose and tax year. A POA can be done at the Legal Assistance office, which is located in the same building, on the south side of the FHTC.

Moore said they will not prepare a return in the following circumstances: more than 10 stocks, more than three rental properties and business owners (unless they operate a child care facility on Fort Hood). They will also not prepare state returns this year.

The FHTC begins receiving clients Monday. Appointments can be made by calling (254) 288-7995 or (254) 287-3294. The FHTC is located in Bldg. 13, on 52nd Street (west of III Corps Headquarters). Services are available to active duty Soldiers, families, retirees and National Guardsmen under Title 10 status for 90 days.

Social Sharing