FORT JACKSON, S.C. (April 2, 2015) -- When a career Soldier decides it's time to hang up the uniform and submits his retirement paperwork to the personnel office, he may think it's all downhill from there.

He would be wrong … Soldiers need to attack retirement just as they would any other activity through planning, preparing, rehearsing and finally executing.

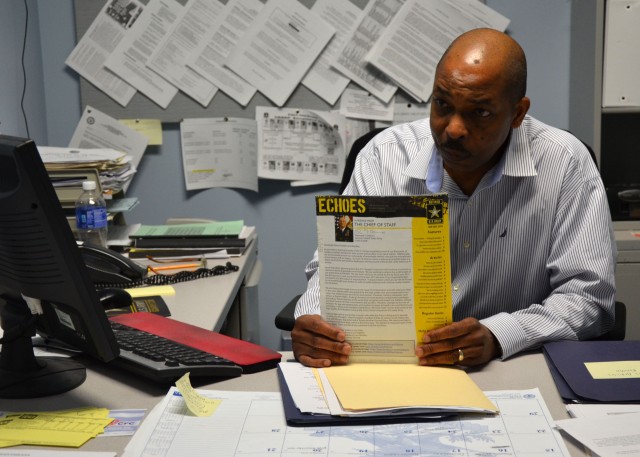

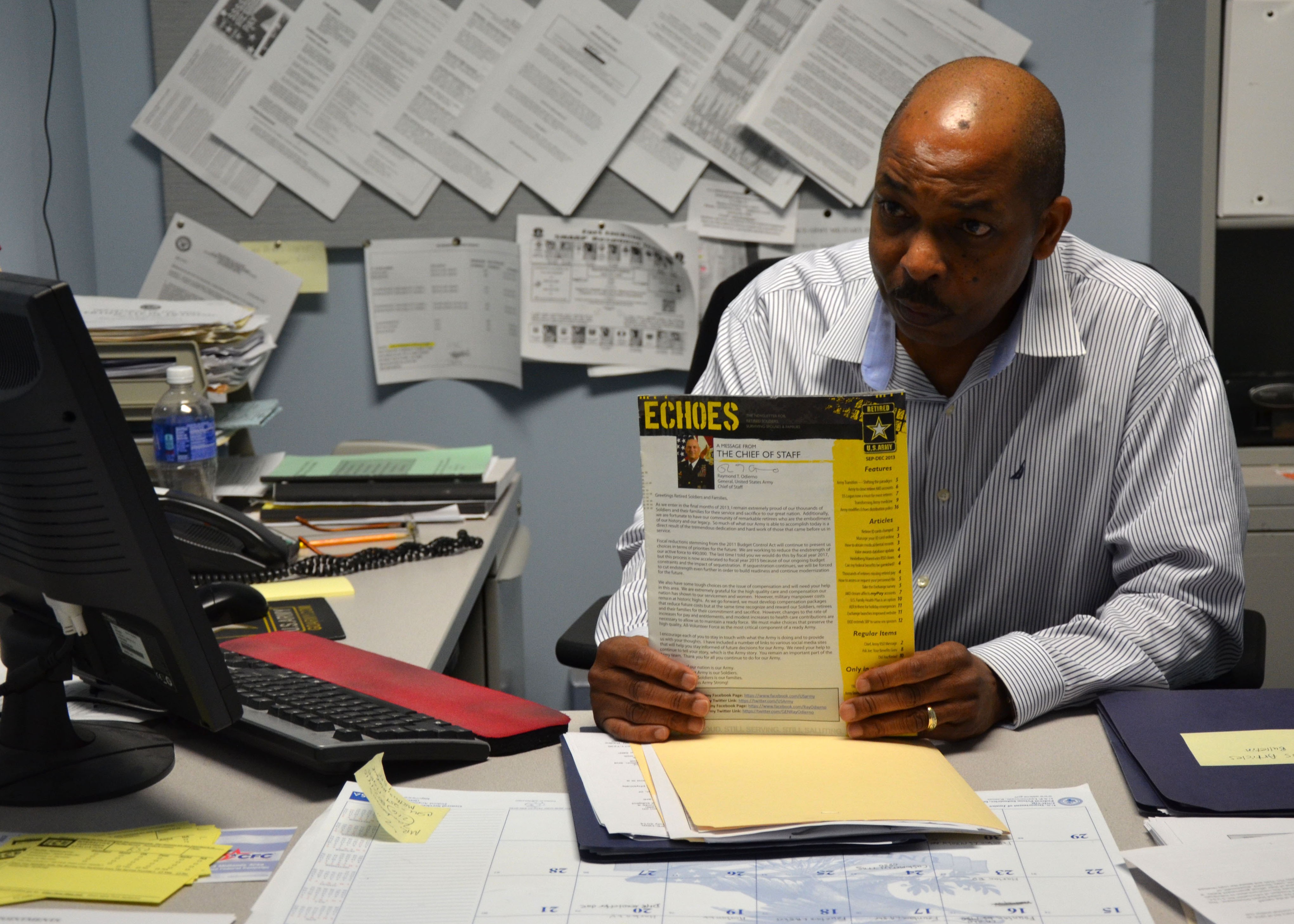

Greg Fountain, Fort Jackson retirement services officer, said the key to retiring from the Army is preparation.

"Once a Soldier decides he wants to retire, he needs to remember, it's not an event, retirement is a process," Fountain explained.

Fountain should know. A career adjutant general Soldier, who retired from Fort Jackson's Solider Support Institute after 22 years of service, he has helped countless Soldiers through the retirement process.

Along the way, Fountain has heard a number of myths and helps direct Soldiers through myriad rules and regulations surrounding military retirement.

"You have to understand, 99.5 percent of the people who are going to retire, this will be their first time retiring from the Army," Fountain said. "So there are a lot of myths out there."

Myths covering taxes, early retirement, the Survivor's Benefit Plan and at what rank a Soldier retires can cause confusion for retiring Soldiers. Fountain tries to alleviate Soldiers' concerns and dispel myths when he meets with them.

IS RETIRED PAY TAXABLE?

Fountain explained there can be a lot of confusion regarding taxable income on military retirement pay.

"Some retiring Soldiers believe they pay taxes on their home of record, or where they joined the Army, but this is not true," Fountain said. "When you retire and take your uniform off, you pay taxes in the state that you reside. You pay taxes in your state of residence. If you take your uniform off here in South Carolina, you'll pay taxes in South Carolina."

He added in some states the retired pay is not taxable, and to further add to the confusion in some places the retiree's retirement pay is taxable, but not taxed by the state. South Carolina is one of those states.

"South Carolina made an agreement with the Defense Finance and Accounting Services that the state will take money out of your retirement check to pay taxes, but it's not South Carolina law to take taxes out," Fountain said. "You have to elect to have taxes taken out, but you are still liable for taxes."

WHAT'S THE DEAL WITH EARLY RETIREMENT?

Fountain said he gets many Soldiers who come to him asking if they can retire at 15 years. This is a popular myth, he explained as Soldiers get tired and want to retire sooner rather than later. But it's not an option for Soldiers to consider.

"You have to be selected to retire early or separate at 15 years," he said. "The Army will give you an option to retire at 15 years; it's not something you can request."

He added almost always the 15 year retirement comes from either an officer selection board or selection from the Qualitative Service Program.

WHO NEEDS THE SBP ANYWAY?

Fountain said he believes retiring Soldiers need to research all aspects of the Survivor's Benefit Plan, or SBP, before making a major decision affecting the welfare of a retiree's spouse and family.

"Soldiers believe because they're active duty that they're 100 percent fit," Fountain said. "They'll be able to leave active duty and get a 1 million dollar insurance policy. So they waive their Survivor's Benefit Plan, and it turns out once they apply for their insurance, they're either uninsurable or the rates are sky high."

For Soldiers who believe they will be better off without the SBP, Fountain said he recommends they have their commercial life insurance policy in hand before seeing him to fill out the data for payment of retired personnel.

"Too many times, I've watched Soldiers say they're going to get insurance and they end up coming back after their retirement date when they find out they're uninsurable," he explained.

However, Fountain reiterated, after the retirement date passes, it is too late to elect the SBP.

SOLDIERS ALWAYS RETIRE AT THE HIGHEST RANK HELD, RIGHT?

Fountain entertains a number of questions regarding what rank a Soldier will retire at with the common belief being a Soldier retires at the highest rank obtained during military service. The difference could mean a loss of thousands of dollars for a misinformed Soldier.

"Some Soldiers believe if they're reduced in grade for some reason, they can retire at the highest grade held. That's partly true, but mostly false. … The key phrase in the regulation … 'Soldiers can retire at the highest grade held successfully,'" Fountain explained. "So if you get reduced through any negligence on your own part, then you won't retire at the highest grade, you'll retire at the reduced grade."

He also said officers need to remember if they were enlisted prior to their commission, then there is a service obligation tied to retirement too.

"If you don't have eight years as an officer, you're going to retire at the highest enlisted grade that you held," Fountain said.

SUCCESSFULLY NAVIGATING THE RETIREMENT PROCESS

Soldiers can avoid the rumors, myths and lore about military retirement by going to the source.

Fountain explained once a Soldier decides to retire, he needs to attend a pre-retirement orientation briefing immediately. Pre-retirement orientations are held quarterly here.

"At the pre-retirement briefing, we have people from all different government agencies come together and explain their portion of the retirement," Fountain said. "We have DFAS, G8 (finance), legal services, TAPS (Transition Assistance Program), and other organizations who come and brief."

Fountain said the next step is for the Soldier to contact his nearest TAPS representative as he can start the transition process 24 months out.

Spc. Kris Henshaw, a food inspector with the Public Health Command, will receive a physical disability retirement in May and completed his TAPS program almost one year ago.

"It was very informative; it was a lot of information at a very rapid pace," Henshaw, who is stationed in Charleston, said of the TAPS program.

The seven-year veteran added since he is receiving a physical disability retirement, the process seemed daunting at times.

"The idea of what my entitlements were being medically retired, there was a lot of confusion," said Henshaw, who is married with two children. "It was very difficult to navigate because there were so many people involved to get answers for the questions (me) and my Family had."

However, Henshaw thought his meeting with Fountain was beneficial, as he sat down to discuss what his retired military pay would look like and whether or not to elect the SBP.

Fountain said another critical step to complete upon deciding to retire is the retirement physical. He stated physicals can be completed no earlier than six months and no later than one month prior to retirement.

When a Soldier comes to the decision to retire from the Army, he needs to research and properly plan his exit. Fountain has stated retirement is not an event, but a process. It is a process with a number of steps and some twists and turns, but with support and a solid plan, the process can be a positive one.

"Start the process and ask as many questions as you can," Henshaw said. "No question is unimportant to ask."

Social Sharing