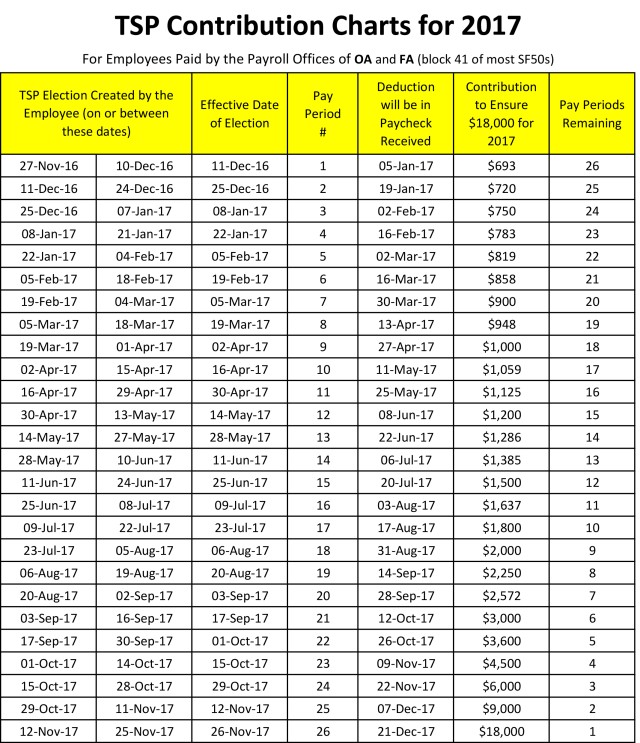

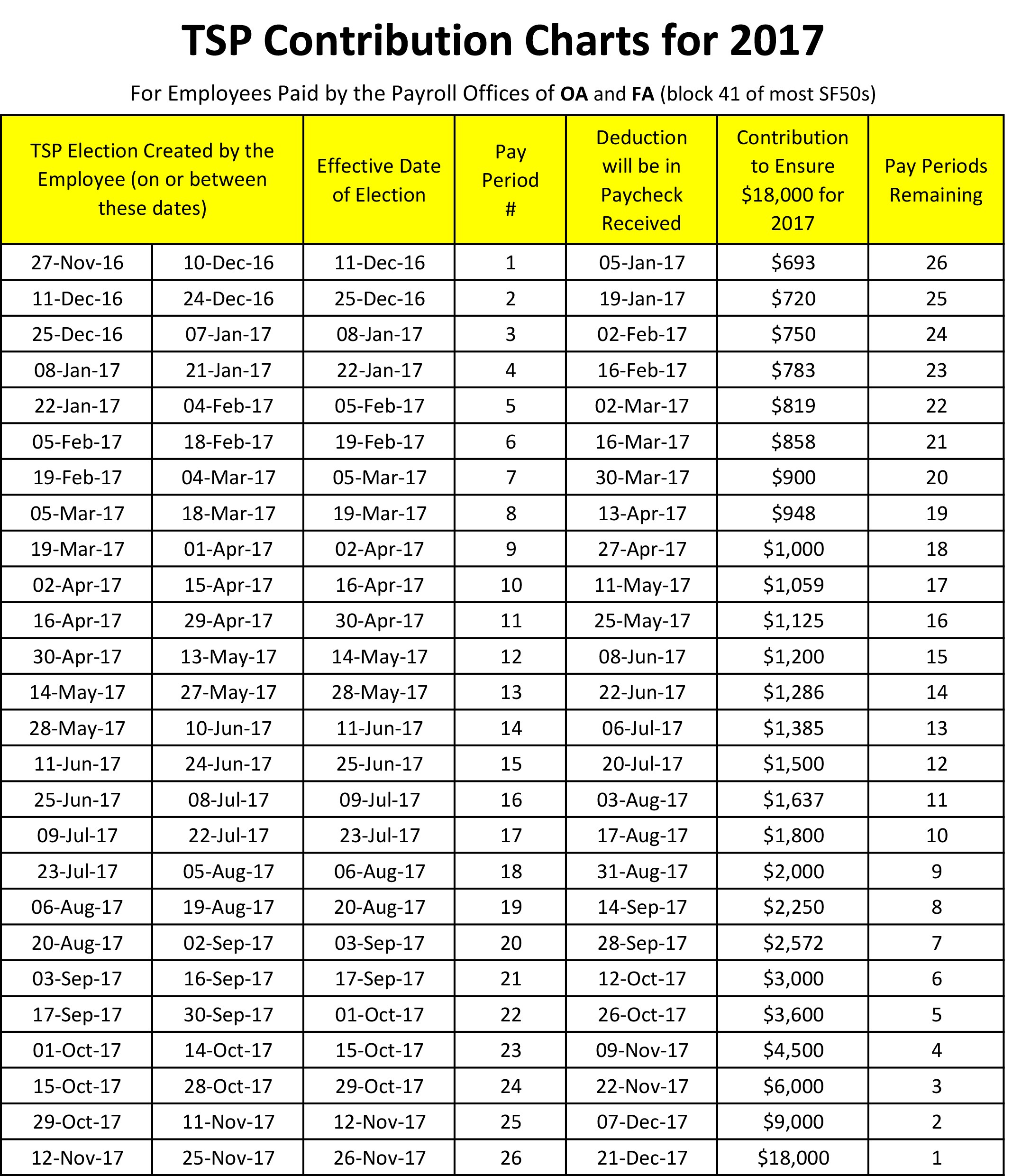

The new 2017 Thrift Savings Plan contribution charts are out, and they are perfect for figuring out how much you may want to contribute to TSP to maximize your contributions.

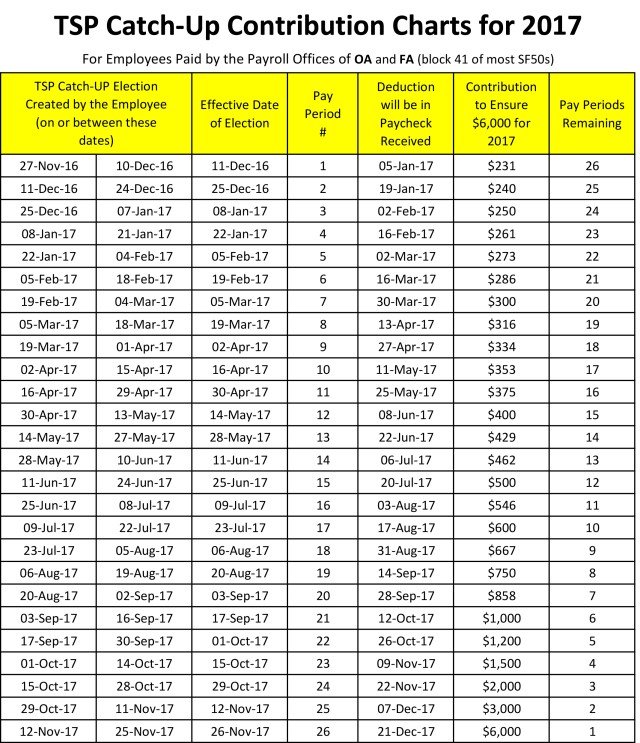

Charts for regular contributions (up to $18,000) and catch-up contributions ($6,000) can be found at www.tsp.gov. Don't delay. Anyone who participates in the TSP Catch-up (i.e. age 50 or older in 2017) must make an election every year. The contribution from last year will not carry over.

TSP Catch-Up (TSPC) contributions are additional tax-deferred contributions to accounts for eligible employees. They are not the same as regular TSP contributions; they are in addition to regular contributions.

Those who are CSRS/CSRS Offset or FERS employees are eligible to make catch-up contributions if they meet the following requirements:

.Currently employed and in a pay status

.Turning age 50 or older in the calendar year during which catch-up contribution deductions begin

.Contributing the maximum allowed to a regular TSP account or an amount that will cause you to reach the Internal Revenue Service (IRS) annual maximum by the end of the calendar year. (This includes situations where one is contributing -- or might have contributed -- to a civilian or uniformed services TSP account (or both) or another eligible employer plan [e.g., another 401(k) plan]. In such a case, if the combined contributions will cause you to reach the annual IRS maximum, employees will be eligible to make TSPC contributions.

The maximum amount employees can contribute to TSP in 2017 is $18,000 for regular contributions and $6,000 for TSPC contributions. Contributions can be started, changed or stopped at any time. Be aware that if the amount elected exceeds the amount of net pay for a particular pay period, no regular deductions will be taken for that pay period. Employees may also receive an extremely small pay check if an election for a large contribution is made in error. Please ensure the election shows the amount of money per pay period that you wish to contribute. Those who do not intend to contribute the maximum to the TSP account for 2017 are not eligible to contribute to TSPC.

Those who want to reach the maximum of $6,000 during 2017 may use the TSP charts for assistance. Once an employee is ready to make the TSPC election, just process through EBIS. Find assistance with help from a benefits specialist, 6 a.m. to 6 p.m. (CST) at (877) 276-9287, (785) 240-2222 or by DSN at 520-2222.

Social Sharing