WASHINGTON — Training and guidance on financial concerns is delivered worldwide in the Army through the Financial Readiness Program, which is designed to educate Soldiers and their families in support of mission readiness.

"Financial stress is a highly-individualized experience and can affect every area of your life. Even the best laid financial plans can go astray," says Robyn Mroszczyk, an accredited financial counselor and the Financial Education Program manager with the Directorate of Prevention, Resilience and Readiness at the Pentagon.

That's why financial readiness training is so important for Soldiers and their families, she said.

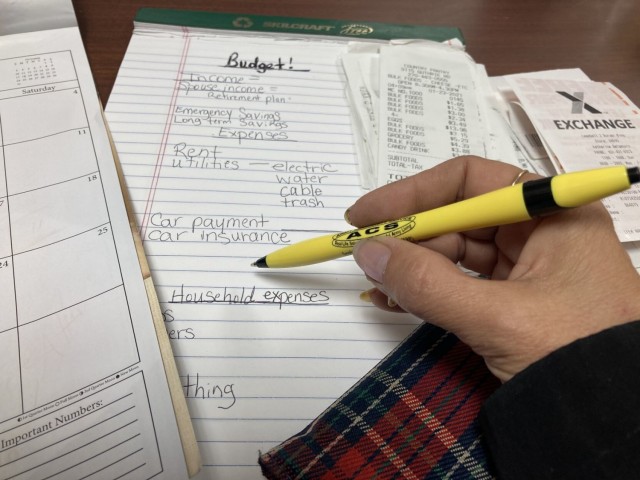

The Army's Financial Readiness Program is available at every installation. The Army Community Service uses the Financial Readiness Program to teach Soldiers, through classroom, online and individual sessions, how to save and invest, how to establish savings goals, debt elimination strategies, and how best to save for emergencies. In addition, National Guard and Reserve service members and their family and survivors can access no-cost financial counseling services with a personal financial counselor through the Office of Financial Readiness website Mroszczyk said.

The Power of Numbers

Soldiers talk about physical fitness scores. Every Soldier is rated by number on how they show proficiency in their individual job. Yet, many Soldiers likely do not know that an important number in their military career is their credit score.

“Many people don’t actually realize, the military has moved to a continuous vetting process in terms of security clearances,” Mroszczyk said. “Every single person must be able to attain and maintain a favorable security adjudication. … That wasn’t always the case,” she said.

“Guess what is the number-one factor for security adjudication?” she asked. “Financial considerations are the number-one reason for security adjudications. And where do they pull that from? From your credit report.”

That means neglecting financial obligations can lead to severe consequences in the military, including negative evaluations, hindered promotion prospects, loss of security clearance, rank reduction, administrative actions and more, she said.

Access to credit, which is determined by an individual’s credit score, is one of the three fundamental issues for new Soldiers when it comes to finances.

“When they come into the Army, they’re going to be faced with a lot of different obstacles. One of them will be their age. It’s going to be the lifestyle that they lead, and their access to credit. Those are the top three,” Mroszczyk said.

That is why financial literacy and financial planning are important for Soldiers of all ranks. It’s critical for leaders to actively engage in addressing these matters with their Soldiers.

“I can’t make you handle your finances. I can empower you,” Mroszczyk said.

Teaching Monetary Management

The Army offers preventative classes in personal monetary management and readiness and consumer affairs classes for Soldiers and family members. The instruction includes an overview of banking and credit union services; budget development and record keeping; the use and abuse of credit; consumer rights and obligations; buying insurance; how critical life changes impact personal finances; and wide-ranging guidance that addresses everything from how to read a leave and earnings statement to financial planning for family separation.

Training is crucial for developing individual strategies to achieve financial goals and maintain financial well-being. The objectives encompass understanding the potential effects of financial decisions on personal and professional lives, acquiring the necessary resources for prudent consumer decisions, navigating financial transactions and practices, and accessing related services and support, Mroszczyk said.

The Army also provides specific classes and videos that touch on three of the most important issues when it comes to personal finances: budgeting tools for spouses; planning for a permanent change of station; and planning for if or when the Soldier is deployed.

Military Travel

As an Army spouse with 10 PCS moves, Mroszczyk understands how transfers can be a challenging milestone for all military families. She said the key to permanent change of station moves is to remember that each move is different, and the next one won’t be anything like the last. What every family should prepare for is to avoid last-minute expenses on a PCS.

Whether a move is months or weeks away, Soldiers and families should have an overall financial plan for a move, an emergency fund to fall back on, and should expect the unexpected, like a flat tire or other disruptions.

“Emergencies can happen. You need to have a plan,” she said.

Financial planning classes and counseling are conducted for all junior enlisted Soldiers, E-4 and below, who are scheduled for their initial PCS move.

Visit the Financial Frontline page on PCSing for more guidance on family moves.

Soldiers on Deployment

Another stressful milestone is preparing for deployment.

“It is an emotional time. Soldiers facing deployment must be able to plan accordingly, set goals, and update their spending plan,” Mroszczyk said.

“Incomes change, expenses change,” she said. “You must be self-aware and be prepared.”

Guidance for considering what to do pre-deployment is available on the Financial Frontline pre-deployment page.

Family Resources

Soldiers and their family can receive financial training from the Army Community Service or through distributed learning on the Army Family Web Portal.

Financial counseling services are also available for Soldiers and family members to help with personal budget development and financial planning, developing a spending plan, managing personal finances, and evaluating assets and liabilities, Mroszczyk said. Spouses are encouraged to attend.

There are also programs to guide commanders in helping Soldiers and their family members with problems of personal financial indebtedness, Mroszczyk said.

These programs help Soldiers resolve a financial crisis by analyzing their assets and liabilities and, if appropriate, enrolling them in a debt liquidation program. Counselors can assist Soldiers in developing a repayment plan and in notifying the creditors that the Soldier is enrolled in the program.

Soldiers are also pre-screened to determine Family Subsistence Supplemental Assistance Program eligibility.

More Online Resources

Guidance offered on post and online explains the varied concepts in standard language and not in military jargon. It helps Army families enhance communications and encourages talking about the state of their finances. Visit MilSpouse Money Mission for more information.

The Financial Frontline website provides a variety of financial literacy resources for Soldiers, families, leaders and service providers.

Army Emergency Relief is the service's nonprofit organization dedicated to alleviating financial distress in the force. AER provides grants and zero-interest loans to active duty and retired Soldiers and their families.

Financial literacy provides the pathway for sustaining financial well-being and resiliency, with benchmarks of meeting all financial responsibilities, building wealth, obtaining a sound financial future and a secure retirement, Mroszczyk said.

Soldiers have a responsibility to be financially literate. The Army has resources to support that. The struggle is when people don’t use them, Mroszczyk said.

Learn more about financial readiness by contacting your local installation Army Community Service Center or Family Service Center or visiting the resource locator library.

Social Sharing