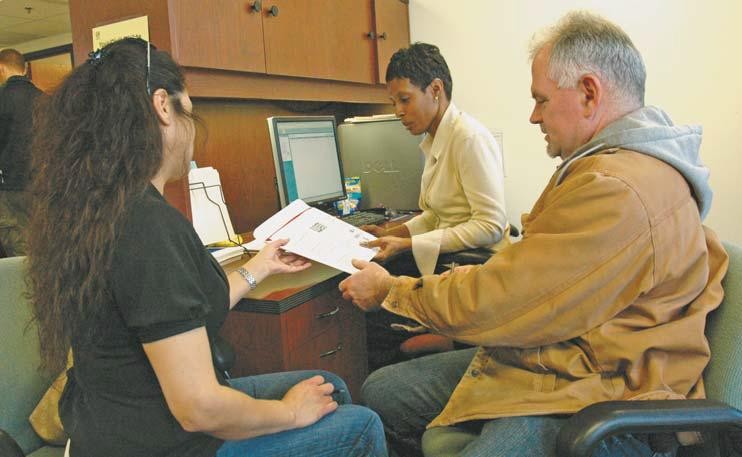

for military retiree Terry Cole (right) and wife Mary Cole at the Client Services Division office, Bldg. 4305, 3rd Floor, Room 317. The installation's Tax Assistance Program, di... VIEW ORIGINAL

ABERDEEN PROVING GROUND, Md. - The installation is offering free tax assistance to active duty troops, retirees and Family members through April 13.

Services are offered at the center in the Office of the Staff Judge Advocate, Client Services Division, Bldg. 4305, 3rd Floor, Room 317.

Installation Tax Coordinator Sandi Framarini called the service a substantial benefit, noting that the tax center prepared more than 1,300 returns and saved clients more than $191,000 in preparation fees last year.

"The biggest benefit is that they do not have to spend money getting their taxes prepared by a vendor off post," she said.

In addition to the free tax preparation, CSD Chief Eric Fuestal said they also offer free electronic filing, a faster, more convenient and more secure method than paper filing.

Electronic filing enables the taxpayer to receive refunds by check or direct deposit. The average return time is approximately three weeks for a check mailed and about 10 days for deposits made directly into a taxpayer's checking or savings account.

Retired Soldier Scott Follett and wife Marsha Follett said that they appreciate APG's free tax services.

"We started coming here four years ago, after we moved to the area," said Marsha. "We think it's a great service, very accurate, and the cost is right."

Several military units have unit tax advisors who prepare taxes for their active duty troops and Family members. Soldiers and Family members should determine if their unit provides this service

before visiting the Client Services Division. Advisors will establish client eligibility and processing guidelines.

Framarini said clients should bring all required documents that must be completed prior to receiving service, under the guidelines of Army Regulation 27-3 and the IRS Volunteer Income

Tax Assistance Program. For the list of required documents, visit www.apg. army.mil, Services Directory, Income Tax Services.

Appointments will not be scheduled over the phone. The CSD staff will review documents to determine if a return requires more than basic preparation.

Returns that take more time to prepare, such as those requiring various IRS Forms and Schedules, will require an afternoon appointment.

General assistance for basic tax returns will be provided on a walk-in basis Monday-Friday from 8:30 a.m. to 1 p.m. Tax services that cannot be completed by 1 p.m. will be deferred to the next business day or scheduled an afternoon appointment.

The office is closed daily from 1-2 p.m. and every Thursday after 1 p.m. From Monday to Wednesday and each Friday from 2 to 4 p.m., walk-in income tax preparation services will not be available, but administrative staff will assist patrons with completing the required documents and

answer questions regarding tax services.

With only one full-time tax preparer on staff, taxpayers can anticipate longer wait times.

Tax services inquiries should be directed to the CSD staff attendant at 410-278-1583. Calls after normal operating hours and those received when the attendant is assisting other clients will

be directed to an automated information line. On touchtone phones, press "3" for the CSD, then "6" for income tax preparation information.

Items needed: Copy of your last tax return (2010), original W-2 statements, social security cards for yourself, spouse, and all dependents, social security income statements, Form 1099 stating interest, dividends or capital gains, distributions from pensions/IRAs, alimony information

child care expenses and provider identification and address, settlement paperwork (for purchase

or sale of home), real estate tax statement, Power of Attorney signed by the spouse if either party plans to sign the spouse's name on a joint tax return (IRS Form 2848 will not be accepted)

blank check with your routing and account number for a refund directly deposited into a bank account.

For those who itemize deductions or own a home that is rented to others, bring: mortgage interest statements (Form 1098), medical receipts, rental reports, investment statements, charitable contribution receipts (name and address of charitable organization, date of contribution and bank receipts for cash contributions)

For stock sold this year, the taxpayer must establish the sales price and the cost basis of the stock before coming to the tax center. Staff cannot calculate these figures.

Individuals who are ineligible for CSD services can use the following websites: www.militaryonesource.mil and www.irs.gov/freefile to take advantage of free self-preparation software.

Individuals in need of free tax preparation assistance by appointment can contact a local Tax Aide Office in Harford County, sponsored by IRS VITA, at 410-638-3425.

Social Sharing