FORT RUCKER, Ala. -- While taxes remain one of life’s certainties, the necessity for military members to pay to figure out how much they will get back from or how much they owe Uncle Sam is not, thanks to a free service offered by the Fort Rucker Office of the Staff Judge Advocate.

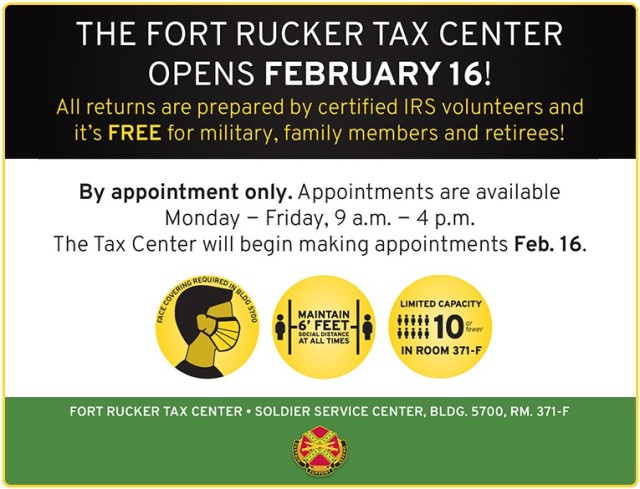

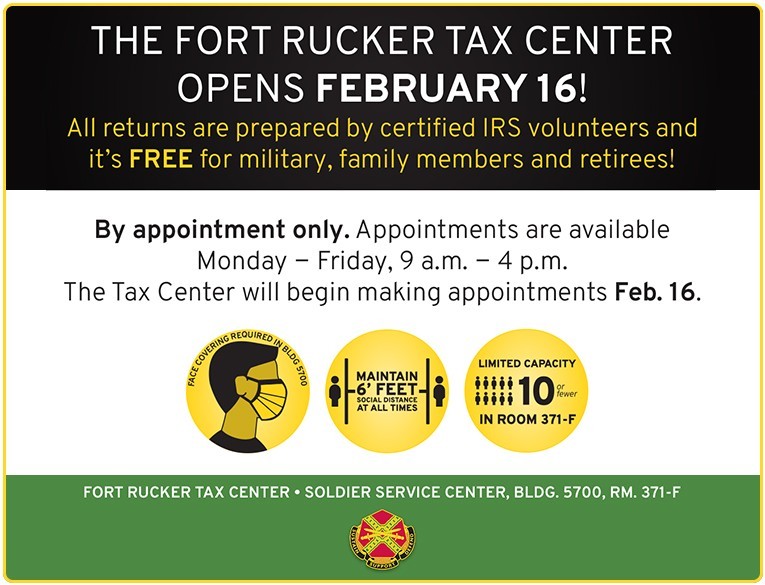

The Fort Rucker Tax Center is set to open Feb. 16 in Bldg. 5700, Rm. 371F, with the goal of providing professional-level federal and state preparation and filing services for no fee to active-duty and retired military, said Tod Clayton, center coordinator.

People need to make an appointment to receive the service and can do so by visiting the center or calling 255-2937, Clayton said. The services are only available to active-duty military, retired military, medically retired military, members of the reserve components on active orders and family members within the Fort Rucker community.

“People can start calling to make an appointment Feb. 16,” he said. “And when people call, they can ask for an appointment for whenever they want it – all the way until we close April 16. If we have an opening, we’ll give it to them.

“We tend to get a lot of appointment requests early on, so if you have trouble getting through, just keep trying,” Clayton said, adding that people will need to keep to maintain social distancing and wear a mask at their appointments. Additionally, children are not allowed at tax preparation appointments.

The office will be open Mondays-Fridays from 9 a.m. to 4 p.m. People need to bring their military ID card, Social Security cards, previous year’s return and all documentation they think they might need to get their taxes done, he said.

New for the 2020 tax season is that people need to know the amounts of what they received through the government’s Economic Impact Payment, also known as stimulus checks. “We just need to know the amounts they received so we can enter that information when preparing their taxes,” Clayton said.

But there are some things the folks at the tax center will not help with, such as businesses or more than one rental property – they will also only do a maximum of two state tax returns per person, he said. “Any of those criteria, or if a person is a day trader, or trading a lot of stocks and dividends, we just don’t have the resources to put in all the data they generate. I’d have to send you to an outside source for assistance.”

For more information on the center, call 255-2937.

Social Sharing