CAMP ZAMA, Japan (March 20, 2019) -- Japanese officials are coming to Camp Zama April 16 through 19 to make it more convenient for military-affiliated vehicle owners to pay the annual road tax.

Everyone who owns a personally owned vehicle in Japan must pay the tax at the beginning of the Japanese fiscal year, which is April 1, said Yoshiji Harasawa, information technology assistant and customer service representative at the Camp Zama Vehicle Registration Office.

"There is a special program on Zama," Harasawa said. "It's helping our (Status of Forces Agreement) members because instead of going to their place (off post), they can come to our place (on post) and pay the road tax. It's a one-stop shop."

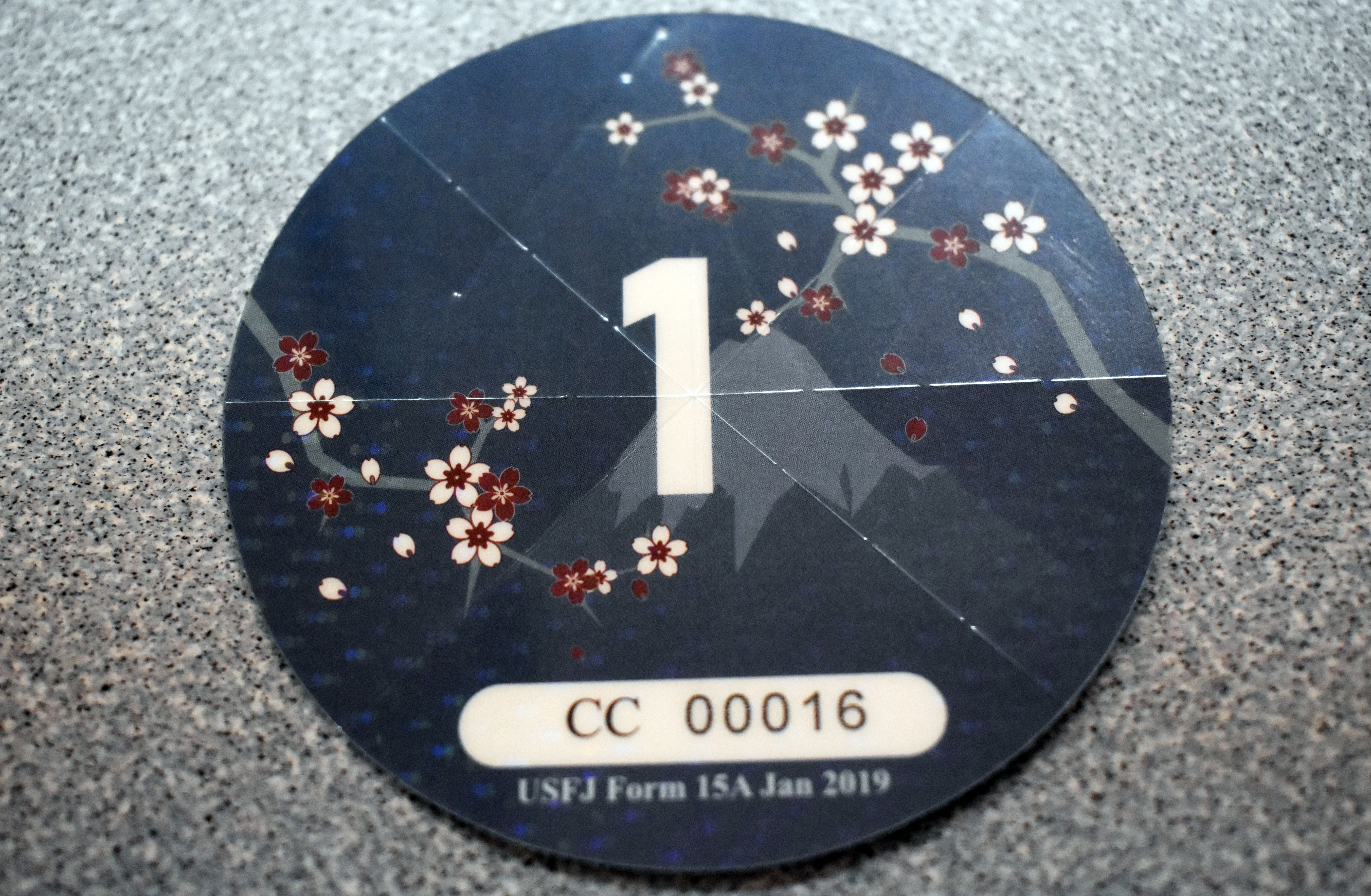

Anyone who does not have the decal on their windshield that proves payment by June 1 will not be allowed on the installation, Harasawa said.

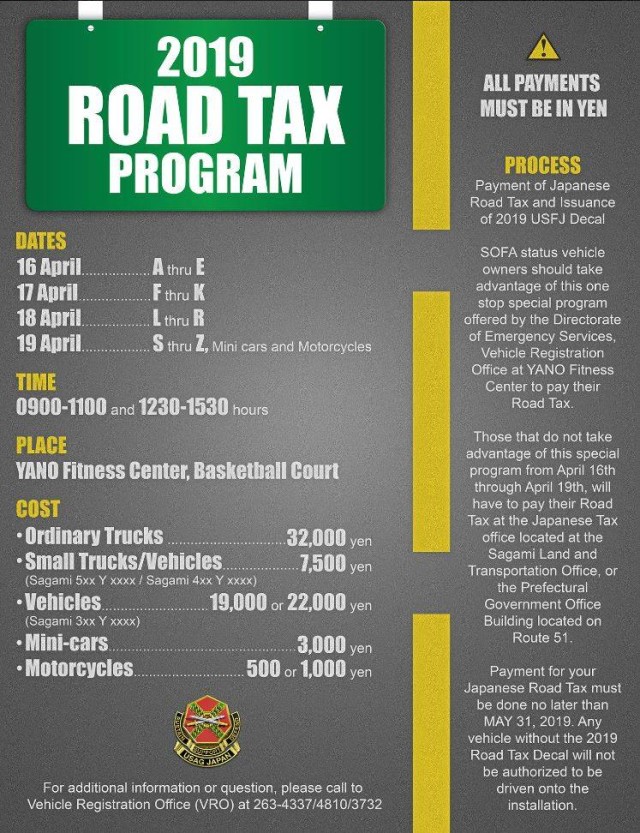

Those with last names that begin with A through E should pay the tax April 16; F through K April 17; L through R April 18; and S through Z April 19, according to the VRO.

Although officials encourage vehicle owners to pay on those dates according to their names, it is OK to pay on a different date if necessary, Harasawa said.

"We don't want to turn anyone down, but the owners of the motorcycles and the mini-cars, they must come on Friday," Harasawa said.

Mini-car and motorcycle owners pay their tax to Zama and Sagamihara City officials, not Kanagawa Prefecture officials, and they will only be at Camp Zama on Friday, Harasawa said.

The event will be at Camp Zama's Yano Fitness Center from 9 to 11 a.m. and 12:30 to 3:30 p.m. daily, Harasawa said.

Vehicle owners must pay in cash using Japanese yen, Harasawa said.

Moped owners pay 500 yen, and motorcycle owners pay 1,000 yen, Harasawa said. Mopeds are classified as having an engine size under 125 cubic centimeters, while motorcycles are classified as having an engine size of 125 cubic centimeters or more.

Most vehicle owners can determine how much tax they must pay by looking at their license plates, Harasawa said, but some will have to look at their vehicle title to find out the engine size.

Mini-cars, which have an engine size up to 660 cubic centimeters, have a yellow plate, and the tax is 3,000 yen, Harasawa said.

Vehicles that have a white plate with a number that starts with three in the top right side of the plate, which is most vehicles, have a tax of 19,000 yen, Harasawa said. Those vehicles' engine size is between 2 and 4.5 liters.

Vehicles with a 4.5 liter engine or larger pay 22,000 yen, Harasawa said.

Small trucks, which are most trucks, and passenger vehicles have a tax of 7,500 yen, Harasawa said. Small passenger vehicles are classified as having an engine size of up to 2 liters.

Ordinary trucks have a tax of 32,000 yen, Harasawa said, but those are rare and most owners would already be aware they own a truck in that category.

While most vehicle owners bring the entirety of the documents they have for their car when paying the tax, it is only necessary to have the Japanese title; the Japanese Compulsory Inspection, or JCI, document; the previous road tax receipt; and proof of liability insurance, Harasawa said.

Everyone, except those who purchased a car in March 2019, has a previous road tax receipt because those who bought a vehicle during the current fiscal year received a prorated charge for the road tax, and will pay the full year's road tax this year, Harasawa said.

This year's decal features plum blossoms and Mount Fuji and goes on the upper center of the windshield, Harasawa said.

Vehicle owners who cannot make it to the event can have someone pay in their stead without a power of attorney, Harasawa said. The person must still bring all the documents and cash.

Waiting times can be as long as an hour, Harasawa said. Vehicle owners pay the tax at one station and then receive the decal at a second station.

Those who do not make it to the event can pay their road tax at the Japanese tax office at the Sagami Land Transportation Office, 7181 Sakuradai Nakatsu Aikawamachi-Aikogun Kanagawaken, or at the Prefectural Government Office on Route 51 at 6-3-1 Sagamiono Minamiku Sagamiharashi, according to the VRO.

For more information, contact the VRO at DSN (315) 263-4337; (315) 263-4810; or (315) 263-3732 or from overseas at 011-81-46-407-4337; 011-81-46-407-4810; or 011-81-46-407-3732.

Social Sharing