FORT SILL, Okla., March 22, 2018 -- In conjunction with Military Saves Week, Army Community Service's (ACS) Financial Readiness Program (FRP) partnered with the City of Lawton Public Library to teach a six-week financial education program.

The Fiscally Fit Boot Camp, a once-a-week interactive class, instructs attendees from the Lawton-Fort Sill community on how to be financially savvy.

According to MilitarySaves.org, "Military Saves Week is an annual opportunity for installations and organizations to promote good savings behavior and a chance for service members and their families to assess their own saving status. Typically hundreds of organizations participate in the week, reaching millions of people."

Zilpa Oseguera, FRP manager, said this is the second time Fort Sill is offering this free course. The first time the course was offered was last summer, and it included a free dinner. Because they had such great participation during the last round, they decided to offer it again but with free lunch, she said.

"The Lawton library contacted me about setting up these classes," she said. "This program is an initiative resulting from the collaborative efforts provided by Friends of the Lawton Public Library, the Oklahoma Department of Libraries and (the Directorate of Family and Morale, Welfare and Recreation) ACS Financial Readiness Program here. The program is a kickoff to Fort Sill's Military Saves Campaign offering empowering financial training to military families at Fort Sill and Lawton civilians. The goals for these classes are to motivate families to save, reduce debt, and build wealth."

The classes meet at 11 a.m. every Wednesday at the Patriot Club. The first class began Feb. 28 and the final class is April 4. Those interested may attend at any point as each session covers a different topic starting from Your Fiscal Strength, Booyah For Your Budget, Credit Crunches and Borrowing Basics, Debt Drills, Training Young Recruits and the final session is Staying Fiscally Fit. The next class will be Training Young Recruits, which is a session talking about children, college funds, and anything to do with finance and raising children.

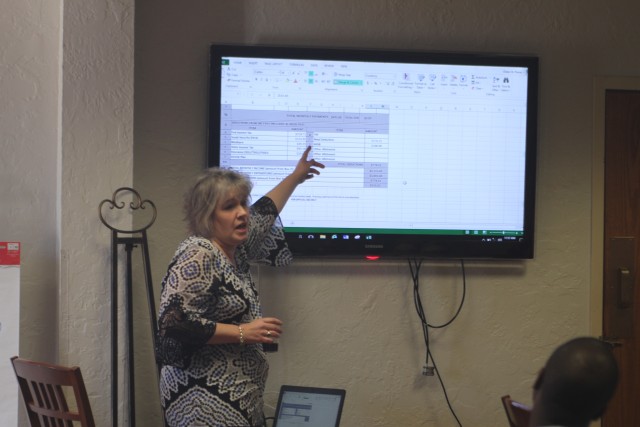

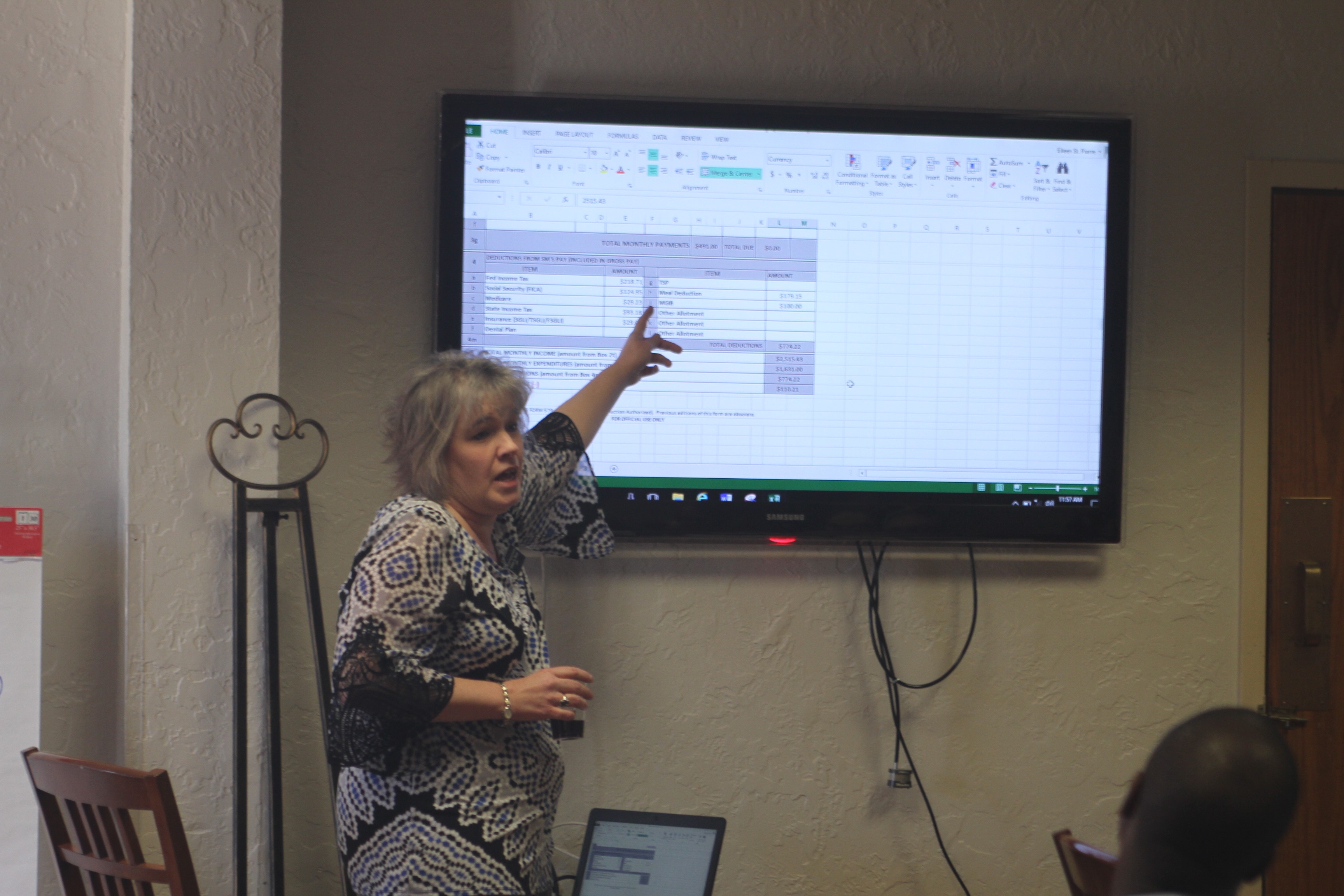

Eileen St. Pierre is the presenter for the class. She is a contract personal financial counselor to Fort Sill, and certified financial planner, who has a doctorate in finance.

"I like that she's very passionate about helping our military families," said Oseguera. "She is very dynamic, and she wants to make sure Soldiers (receive the help they need). If she sees that there's something else that can be beneficial, she'll refer them over to AER (Army Emergency Relief) or other community agencies."

St. Pierre said her goal for everyone who comes to any of the sessions is to be empowered and to take control of their own finances.

"In the military, commanders always want their Soldiers to be mission ready," she said. "Financial readiness is a key part of that. And even for the whole military community at large, if you are in control of your own finances, it reduces a lot of stress in your life and there's a lot more things you can accomplish when you're in control of your own money; we want people to make wise decision."

Oseguera said the key thing for the military and FRP is give Soldiers and their family the means to be financially ready.

"Studies have shown … that military families that use these family programs will experience a higher level of resiliency and financial stability, which translates into higher productivity and mission success for the Army," she said.

Yoonhee Bruce, web designer for FMWR and wife of retired Sgt. 1st Class George Bruce, said the class boosted her confidence in making more educated financial decisions when it came to large purchases, such as if her family should buy or lease a car or buy or rent a house.

Bruce and her husband attended all six classes last summer and said they learned basic to in-depth skills.

"If you have debt, so much debt, then you can learn how to manage debt from smalls ones to big ones," she said. "You will learn something from the class even if you are financially stable or not … If you don't like it you can just drop (the class), if you like it you can keep coming and finish the course."

For Bruce, an advantage of participating in the program was not having to prepare dinner as the classes were offered in the evening previously.

"(St. Pierre) has lot of knowledge about finance," Bruce said.

The class is about one-and-a-half hours long, and Bruce said usually every minute is needed to cover the subject matter.

The Financial Readiness Program staff will hold another round of the courses this summer. For more information on classes or to inquire about financial advice, call 580-442-4916.

Social Sharing