FORT CARSON, Colo.-Two Colorado state commissioners visited Fort Carson during a Military Saves Week program run by Army Community Service Feb. 24 to talk to Soldiers about investing safely and beginning a savings plan.

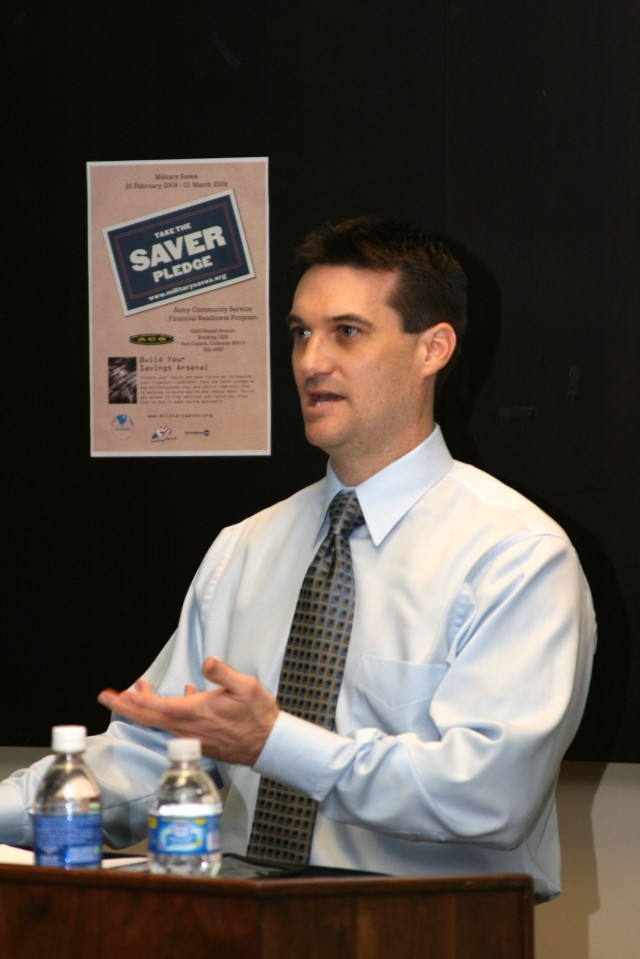

Fred Joseph and Chris Myklebust, the Colorado securities commissioner and commissioner of financial services respectively, spoke about developing a savings plan and avoiding fraudulent investors.

Myklebust stressed the role a savings plan can play in staving off creditors and living a comfortable life.

"One thing I can promise you a savings account will do is it will allow you to buy back your life," Myklebust said.

People trapped in a cycle of high-interest loans can use money in their savings accounts to secure low-interest loans, he said.

"I would encourage you to use your savings in that way," he said. "Don't spend it, but, if you're in a high-interest environment where you're not really making it, use that to secure some cheaper financing and get the heck out of that high-interest cycle."

That savings account should equal three-six months of one's salary, he said.

"Take the smallest piece that you can and get to that point first," Myklebust said. "Life is about reaching milestones and about overcoming obstacles one at a time. The easier and more realistic you make a savings plan, the easier it is for you to reach it."

While putting money aside for savings may be difficult, Myklebust told the Soldiers that it is a reachable goal.

"Savings is a sacrifice," he said. "You have to use what you have efficiently and most effectively. Break down the resources you have on a monthly basis and factor out what it's going to cost to live, how much you have for entertainment. Then, for two months, track where your money is being spent.

"I promise you, you can find 5 percent of what you get - just 5 percent - to put away into a savings account and just let it build over time."

While some may use the savings account as a buffer for emergencies that inevitably come up, others might use it to start investing.

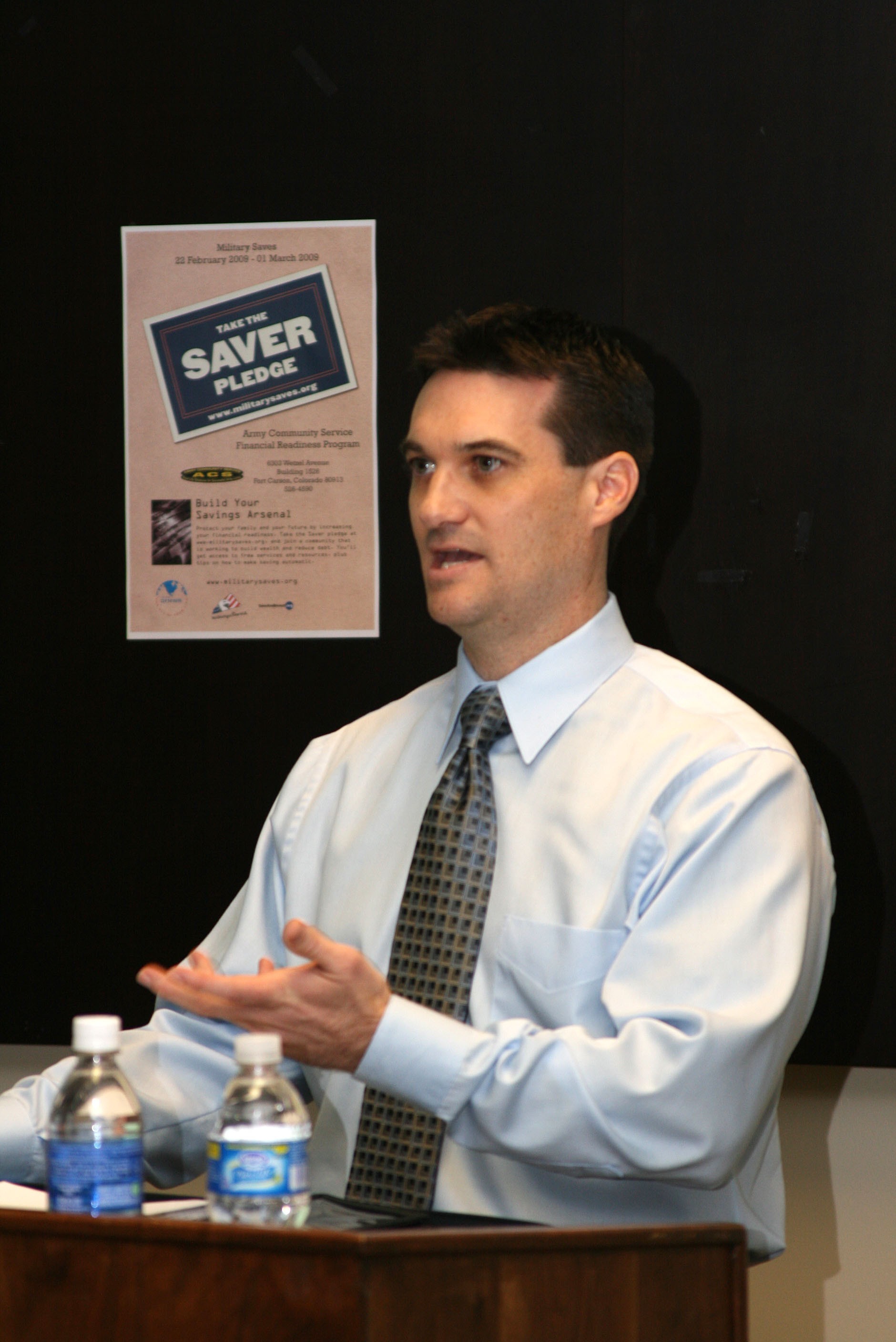

This is where Joseph said people should be wary.

As the state securities commissioner, Joseph is a watchdog of sorts. His commission licenses stock brokers, registers securities and goes after fraudulent or unlicensed brokers, he said. Joseph showed news clippings of some of the brokers he pursued civilly and criminally. Some were simply given cease-and-desist orders because they were not licensed in Colorado. Others were prosecuted criminally for fraud and handed prison terms - one of which was a sentence of more than 300 years.

"There are people out there that prey on other people, and Soldiers would be no different than anybody else. They go after your money; it's just as green as everybody else's."

Some of the Soldiers were taking notes during the presentation, and at least one of the Soldiers found it both informative and eye-opening.

"A lot of (Soldiers) don't know the dangers out there when it comes to investing," said Spc. Christopher Wilkes, 4th Engineer Battalion.

"It's very easy to get ripped off."

The event was part of Military Saves Week, which ran from Feb. 22-March 1.

Social Sharing