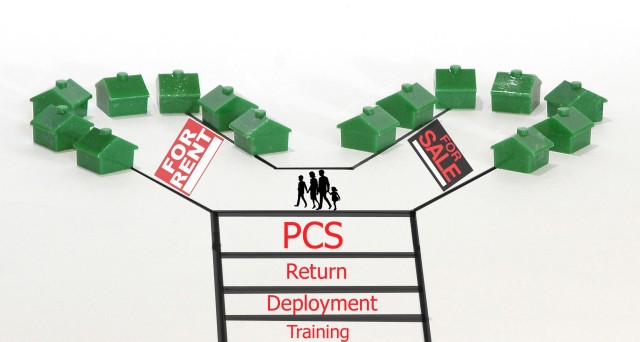

FORT LEWIS, wash. - With every PCS, Army families have to ask themselves whether to rent or buy a home at their newest duty station. And with all the doom and gloom in the news about the mortgage meltdown and the real estate market, that decision can be even more daunting.

But never fear. It doesn't have to be as complicated as it seems, especially if you do some home-work first.

"First and foremost, especially for military and the market we're in right now, is evaluating how long you are going to be in your current location," said Darryl Snow, who teaches the home buying workshop on Fort Lewis. The current real estate market is not growing as fast as it was in previous years, said the buyers agent and Army retiree. While there is no hard and fast rule on how long a family has to stay in a house, Snow estimates that the current market requires about three years before families will break even or turn a small profit.

"Any time less than that, the chances of breaking even are diminished," he said. For those who have already purchased and are now faced with selling at a loss because of PCS, Snow suggests looking at renting out the property and allowing it to continue to appreciate in value.

Once a family has decided to buy a house, the next step is to get financially prepared. Sit down with a reputable mortgage lender and go over your budget and really evaluate your finances, said Kathy Randich, a mortgage lender and teacher of Fort Lewis' home buying workshop. Start by choosing that reputable mortgage lender.

Ask trusted friends and colleagues whom they recommend, Randich said.

"The best way to get to a good person is to ask a good person who has used that person," she said.

Next is to choose a product.

With the mortgage meltdown on the evening news every night, consumers may be a little squeamish about choosing a loan. But, Randich said, the products that caused the problem are no longer on the market.

"All lenders are going back to the old way of doing business where you have just the normal conventional, FHA and VA-type loans," said the 17-year veteran of mortgage lending. "It's not going be easy for people to get tricked."

Currently, it is a buyers' market, Randich said. There are some great opportunities out there for first-time buyers, especially those who qualify for VA financing.

"There's no better loan program out there right now than VA for a first-time home buyer," she said. "First of all, VA is a government insured loan, so it has no monthly mortgage insurance and you can still go zero down."

But just because a family can buy a house with no money down does not mean that having some savings is unnecessary. Taxes and insurance are part of the expense of home ownership. For those used to renting, there are costs to consider that become a homeowner's responsibility. Repairs, maintenance and equipment costs must be considered as factors when deciding whether to rent or buy. A family should have at least 1 to 3 percent of the house's value in savings for repairs, extra utilities and other unforeseen expenses, according to Tina La Bouve, marketing coordinator for the Homeownership Center of Tacoma.

"The coldest day of the year, that's when your furnace is going to go out, so just make sure you have something set aside," she said.

Another thing to keep in mind is being well represented by an experienced real estate agent who knows the market and the business and can answer a lot of questions, Snow said.

"Buying a house is a pretty complicated process," he said.

Having a good, seasoned agent will help navigate the complex process, Snow said.

The best way to prepare for purchasing a home is to do some homework, La Bouve said. Go to a workshop, talk to people you know who have purchased homes and talk to a reputable real estate agent.

Fort Lewis offers free home buying workshops to the community at Stone Education Center. The next workshop will be Aug. 19 and 20 from 6 to 9:30 p.m. in the main auditorium of Stone Ed. At the end of the workshop, attendees will receive certificates that entitle them to use more than 100 programs, many of which are geared toward first-time buyers.

Rachel Young is a reporter with Fort Lewis' Northwest Guardian.

Social Sharing