FORT DRUM, N.Y. -- Although civilian employees have not received their official furlough notices, it is important to be prepared to weather a potential financial storm.

If civilian employees are furloughed, it is possible that many will face a 20 percent or more reduction in pay.

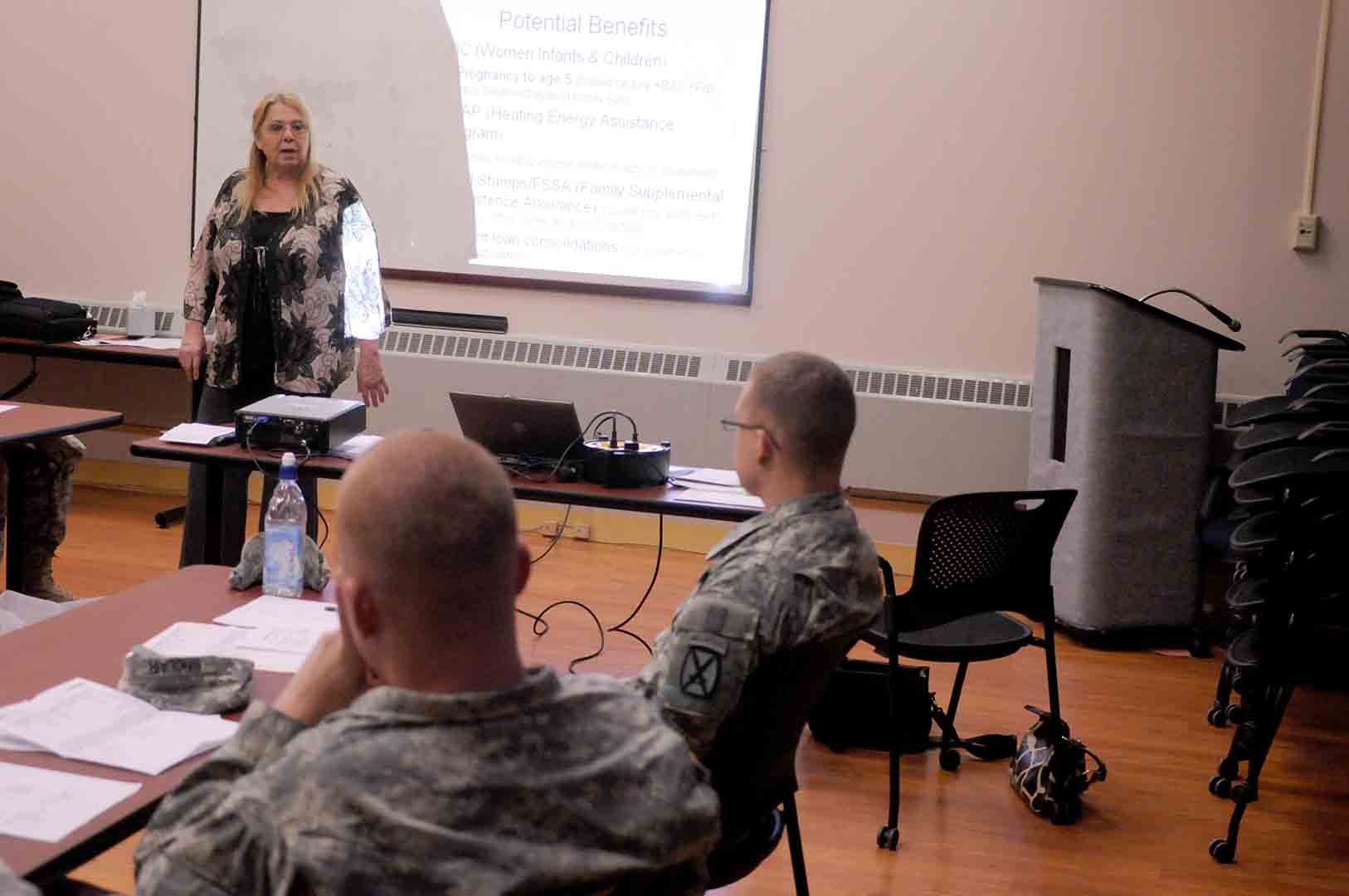

"Twenty percent is a lot of income," said Judee Kelly, Financial Readiness Program manager and accredited financial counselor. "The majority of people do live to their income standards … so when all of a sudden 20 percent or more is gone (from their paychecks), they need to restructure their spending and not wait for things to get to the point where we feel stressed."

Track spending

People minimize their actual spending, Kelly said. A good way to prepare a budget is to track spending and write it down. She recommends tracking every purchase for a minimum of two weeks and double the amount to account for a month's worth of expenses. Tracking for an entire 30 days is ideal.

Tracking is easy: get a notebook, write down all purchases, categorize them, and total them, Kelly explained.

"Find out where you spend every single penny; don't guess," she said. "If (people don't) know what they're spending, I can't help them create a realistic budget.

"No one likes tracking, but once you get it mapped out, you have a clear vision of where you need to go with your money," Kelly added. "Work off of a zero-based budget and give every single dollar a place to go; don't leave a single cent on the table."

Kelly also recommends added overdraft protection on bank accounts for extra security.

Restructuring debt

After tracking purchases and creating a budget, if people still have a deficit in their money, restructuring debt is the next step, Kelly said. Credit card companies are usually willing to assist customers rather than letting them default on their payments.

"Creditors can't make money off of you if your credit score is too low for them to be able to give you a card," she said.

Financial Readiness Program counselors can assist customers in dealing with creditors. Some options creditors can provide are increasing credit limits, reducing monthly payments and interest rates, or deferring payments.

Build savings

After reducing their spending and getting their finances back on track, people should continue following their budgets and begin building or rebuilding their savings, Kelly said.

"That way, if you have any small emergencies, you'll have money to pay for it without blowing your budget," she said, adding that people should hold off on any large purchases if possible.

"Don't allow the situation get you deeper into debt," Kelly continued.

Stick to budget and set goals

Budgeting is an important life skill, and reducing excess spending is part of learning to live on a budget.

"Don't think you have to eliminate things; just think 'reduce,'" Kelly said.

For example, people can do small things like opting for basic television channel packages instead of paying extra for premium services, Kelly noted. Also, people can bring sodas, meals, snacks and coffee to work with them instead of visiting the vending machine or dining out.

"The average person spends $200 a year on vending machine purchases," Kelly explained. "There are a lot of strategies to reduce expenses a few cents at a time."

Another smart budgeting tactic is setting goals.

"Goal setting is not just a good idea for resiliency, but it's a foundation of our budget," Kelly explained.

"It doesn't matter what your goal is -- whether it's getting out of debt or whatever it might be -- those things deflect unwanted spending from friends, spouses, family and children.

"When we tell children what our goals are, we are teaching them how to set goals," she added. "When you look at the child who you love, think of (him or her) as an adult struggling with financial issues. None of us want that for our children. We have to educate ourselves on finances so we can educate our children."

Resources

Kelly and her staff, along with master resiliency trainers, also will provide information to civilian employees at "Thrive through the Furlough" workshops from 9:30 to 11:30 a.m. Friday and from 1:30 to 3:30 p.m. April 4 in Bldg. P-219, Nash Boulevard. To sign up for either workshop, call 772-2848.

"The workshop will definitely help (civilians learn how to) ease the financial impact of (what may be) to come … and make a plan to move forward," Kelly said.

Army Emergency Relief provides interest-free loans and grants for active-duty Soldiers, retirees and their Families. For information, call 772-6560.

Civilian employees facing financial hardships also may be eligible for the Federal Employee Education and Assistance Fund. Loans and grants are provided to federal employees dealing with personal hardships, loss of property, medical emergencies and short-term assistance. For more detailed information, call 1-800-323-4140 or visit www.feea.org/gethelp.

Kelly and her staff of accredited financial counselors are available for one-on-one confidential counseling. Appointments are required for individual assistance, but the Financial Readiness Program located at Army Community Service has a lending library stocked with books and DVDs, as well as other resources, forms and guides for people to take home.

Budgets are created on a person's needs and values, so one budget will not work for everyone, Kelly noted.

"All of the counselors here are aware of that," she said. "We're not here to tell you how to spend your money; we're here to assist you with how you want to spend your money and help you come up with plans and ways to save.

"We look at each case differently and give the best advice for each individual situation," Kelly added.

For more information or to make an appointment with Financial Readiness Program counselor, call 772-5196.

Social Sharing