HOHENFELS, Germany -- Members of the 527th Military Police Company got a crash course in personal finance as the Army Community Service Financial Readiness Center conducted an intensive two-day seminar for Soldiers and spouses in Hohenfels, recently.

The class was initiated by Capt. Carlos R. Guevara, 527th MP company commander, who said many Soldiers across the Army live paycheck to paycheck.

"I want my Soldiers to have the opportunity to know that there is another way," he said. "I think the classes that ACS provided will give them a head start."

The two-day overview included everything from balancing a checkbook to buying a home and saving for retirement.

"Starting from the basics is the way to go," said Donna Gotell, Financial Readiness Program manager. "When we do money management, banking and checking, it might be boring for some, but for others, they've never seen this before."

"We did an awesome class on check writing," she continued. "They had to balance their register, and if they were struggling with it, that means they need to come see me so we can do a one on one and I can get them on track."

During the "Understanding Money and Credit" portion, Gotell stressed creating a budget and setting some long-term financial goals. She said people often don't realize where or how much money they are actually spending, especially if they make most purchases with a debit card.

"We don't pay attention when we're using our card, we're just getting what we want," she said.

In an exercise, Gotell had Soldiers consider how much money they spent a day on coffee, cigarettes and other small items.

"One guy said he spends about four dollars a day on coffee," Gotell said. "That adds up to $1,400 a year. Now what do you think you could have done with that money? You could have paid off a small balance on your credit card or saved for a vacation."

"I'm not telling people to stop drinking their coffee," she added. "But if we can just cut half of that, it can make a big difference."

Another class covered "the three deals of car buying" such as the purchase, the trade-in, and the financing. Saving for College discussed the rising cost of education and different ways to save for your child's college, such as 529 plans.

"It's going to be useful for a lot of people. They gave some very helpful pointers," said Spc. Jennifer Adcock.

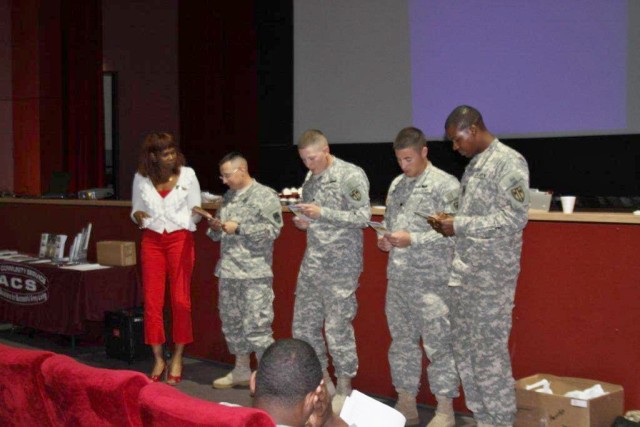

Cupcakes and "Monster" drinks prizes helped keep the Soldiers engaged.

"One or two of my Soldiers stopped by and said 'Sir, thanks for (the class)," said Guevara. "We had an FRG (family readiness group) meeting and the spouses were talking about it, so I believe it was a success."

"It was worthwhile," agreed Spc. Akira Shinomiya. "A lot of guys just spend their money on stuff, very impulsively. This gave a lot of information and it was presented well."

"And the cupcakes helped," he laughed.

Social Sharing