Two representatives from a newly-created federal consumer oversight agency were the guests at a town hall meeting April 13 at Spates Community Club on Joint Base Myer-Henderson Hall.

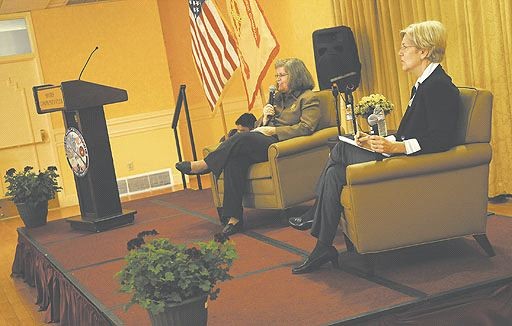

Elizabeth Warren, assistant to the president and special advisor to the secretary of the Treasury on the Consumer Financial Protection Bureau, and Holly Petraeus, head of the CFPB's Office of Servicemembers Affairs, addressed an audience of military personnel and Family members on the mission of the bureau and its role in protecting consumers from predatory lending practices and other financial service industry abuses. The two women made brief presentations then took questions from the audience.

Although the bureau isn't scheduled to stand up until July 21 of this year, Warren and Petraeus have been making the rounds of installations to educate the military about the agency's mission and listen to the concerns of Family members that fall under the bureau's purview. The duo was recently in Norfolk, Va., and is traveling to Wright Patterson Air Force Base, Ohio, and Fort Bragg, N.C., in May.

Warren described the bureau as ''a three-legged stool" emphasizing the pillars of ''consumer education, rule writing and supervisory enforcement"

''We want to be a voice for the American Family, and a significant part of that is the military Family," she said. ''We want your input. We want to make sure your perspective is built into the DNA of this agency."

Introducing herself to the audience, Petraeus, daughter of a former superintendent to West Point and wife of Gen. David Petraeus, head of U.S. forces in Afghanistan, said she'd been a military spouse for 36 years.

''It's hard to recall," she said, ''but we were once a young Army couple with little money." She remembered the couple at one point naively booking a hotel sight-unseen because of a pretty picture in a brochure, an image undone upon arrival by a heavy police presence at the location.

''A lot of fraudulent deals are waiting for you," Petraeus warned, ''especially on the Internet."

With their steady paychecks and a culture that discourages debt, the military is a ripe target for unscrupulous lenders, Petraeus said. ''Check military loans [on the computer] and you get about 700 responses all wanting to ''help" you," she said.

Input from military personnel and Family members is essential in creating an effective watchdog, she said, adding, ''We want you to help us decide how the Office of Servicemember Affairs will operate."

The bulk of the hour and a half session was devoted to Warren and Petraeus fielding questions. ACS Financial Readiness Program manager Leonard Toyer asked whether anything could be done for servicemembers who acquire debt prior to becoming active duty. One woman with a teaching certificate, who lamented how she had to constantly get recertified in a different state as she moved from one duty station to another, asked whether some kind of national certification system could be put in place for military spouses. Lt. Col. Cameron Leiker, commander of Headquarters Command Battalion, said maybe it would be better if the military's Thrift Savings Plan was made something Soldiers needed to opt out of rather than join. That way, young enlisted would be more inclined to save money, he said. ''If you don't see it, you forget it and it accrues."

Warren and Petraeus scribbled on notepads as questions were asked or suggestions made and a bureau emissary sometimes waded into the audience to retrieve contact information from speakers for later follow up.

Tiffany Hays, a Family member and financial counselor fellow at JBM-HH Army Community Service, said she appreciated that the majority of the town hall had officials taking questions.

''It was fantastic. The forum was impressive because it showed the [women's] strength of knowledge and character [in fielding questions], not knowing what was coming at them," she explained.

''It said, 'Hey, we're here to listen ... to find out what you know," Hays said. ''It was very empowering to military Families."

''I liked the relaxed atmosphere," said Sarah Hertig, another Family member and ACS outreach counselor. ''I thought the licensing issue was important. Spouses need to sustain their careers when they move."

Hertig thought Leiker's point about having to opt out of TSP was important to consider as well. ''Young kids coming in [the Army] don't see the next day past the drill sergeant," she said.

For those that missed the town hall meeting, the bureau has an interactive website with information about the scope of the agency: www.consumerfinance.gov.

Questions about the agency can be e-mailed to military@treasury.gov.

Social Sharing