Today, everything is done online or through an application (app) on our phone. Whether it’s ordering groceries right to the door, paying the mortgage, or applying for a new credit card, this can all be achieved within ten minutes using a website link or an app. Gone are the days of locating an ATM to withdraw cash for the week, visiting the local bank to apply for a loan, or sending a check in the mail and waiting days to weeks to verify the check was received and deposited. As commercial companies modernize and enhance their online platforms to provide the most relevant and timely information possible to their customers, it is crucial that the U.S. government implement similar modernized technologies, for ease, for transparency, and for audit. However, like most things, it’s easier said than done.

The U.S. government has the most complex business processes known to man with trillions of dollars moving back and forth between agencies and archaic systems that lack the transparency seen in the commercial space. The U.S. Government is comprised of offline systems, documents being emailed back and forth and stored in various locations, inconsistent data, and transactions hitting each trading partners’ accounting ledgers at different times. After decades of using this manual, offline process ultimately leading to the inability to account for all transactions that took place throughout the years, the U.S. Treasury developed a system, called Government Invoicing, or G-Invoicing. This capability is intended to remediate the biggest and most well-known issues within the current process.

“G-Invoicing is the future of intragovernmental transactions. Successful implementation of the tool will only occur through steadfast collaboration and mutual support across federal agencies.” said Wes Robinson, Deputy Assistant Secretary of the Army, Financial Operations and Information.

While G-Invoicing’s is critical to the Department of Defense (DoD) reaching an audit opinion, the implementation is not as easy as the commercial space. The commercial space does not have the extensive regulatory guidance required to follow and can quickly implements systemic changes more efficiently; releasing new features and functionality that customers immediately use it as the app automatically updates instantly. DoD implementation takes significantly more investments in updating plans, action, and measured expectations. This initiative redefines the DoD's internal operations by introducing new systems, refining processes, and training personnel. Most importantly with such vast organization, this implementation impacts nearly every team member from top to bottom; we need engagement, within the Army and across the U.S. government, being proactive, informed, and doing their part to achieve this monumental task. There’s strength in our Nation with collaboration and we need your help working together to ensure a successful transition.

Background

U.S. Treasury’s G-Invoicing system is the long-term solution for Federal Program Agencies (also known as “trading partners” or ‘Federal Agencies’) to manage internal federal government buy & sell transactions. Some of these transactions include the food and uniforms purchased from Defense Logistics Agency (DLA), the ammunition sold to other military services, the support Federal Emergency Management Agency (FEMA) provides during a natural disaster, and so much more. G-Invoicing will ensure the U.S. government has general terms and conditions (GT&C) in place before purchasing and selling between agencies. Discrete and detailed information will be documented on the goods and services being purchased/sold and systemic checks will be put in place to ensure all entities are sharing the same data and recording the business events within the same accounting period. U.S. Treasury’s mandated system will improve accuracy and transparency of purchases and sales within the DoD and federal government and encourage users to communicate effectively with trading partners in a seamless, collaborative effort.

In FY21, the Army generated over $110B in revenue from the intragovernmental sale of goods and services and purchased $70.2B worth of intragovernmental goods and service. Intragovernmental transactions (IGT) for the Army represented nearly thirty five percent (35%) of the Army’s annual budget. The transition and implementation of G-Invoicing is critical to remediating the Army’s material weakness related to IGTs and numerous other notices of findings and recommendations (NFRs) required to achieve and maintain a favorable audit opinion.

"As we embrace modernization, our focus is not solely on implementing tools but on crafting comprehensive solutions that address historical audit challenges,” said Nikki Cabezas, Director, Financial Information Management (FIM). “Although implementing such a complex and comprehensive process has not been easy, it is essential to ensure we as federal stewards of tax-payer dollars provide accountability on the purpose, time, and amount of Army funds. Within FIM we are poised to develop and sustain Army Financial Management systems, data, and capabilities that epitomize efficiency, compliance, and transparency.”

G-Invoicing will provide the Army with the opportunity to modernize and remove the manual and inefficient business processes that currently plague the DoD. U.S. Treasury and the Office of the Under Secretary of Defense – Comptroller (OUSD(C)), require Army leadership to drive the Army’s compliance and business process reengineering efforts to align to this imperative initiative. But that can’t be accomplished without your support.

Changes Coming with G-Invoicing

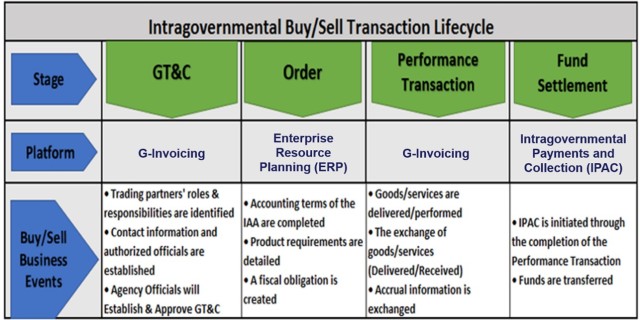

G-Invoicing has four major components in its process: General Terms & Conditions (GT&C), Orders, Performance, and Funds Settlement. These steps are consecutive and must be achieved before moving on to the next step (see accompanying graphic: Intra-Governmental Buy/Sell Transaction Lifecycle, which depicts each step of the process and the business events within each step.)

Collaborating with the trading partners to complete the general information, outlining the requirements for the fiscal obligations as well as establishing what goods and services will be exchanged or delivered, and then ensuring those funds are settled for the transaction emphasizes the importance of our need to work together as a team and to communicate consistently throughout the process. The expanded explanation of the lifecycle below provides further clarification on the various changes associated with each component of the G-Invoicing process and the necessary teamwork required to achieve each step.

General Terms & Conditions

Let’s use a common example, signing up for a Netflix account. Before creating an account, a user must agree to Netflix’s terms and conditions. Similarly, before trading partners within the federal government try to do business with one another and process transactions, they must establish a GT&C that documents the roles and responsibilities of each trading partner. This establishes the scope of the business to be performed, the roles of each trading partner, and information to ensure communication is achieved amongst the trading partners. It also provides one centralized storage repository for all GT&Cs to be reviewed and referenced.

One big change with G-Invoicing is the strategy for brokering GT&Cs. Instead of having multiple support agreement managers at each Command throughout the Army draft these GT&Cs for each individual or redundant order, ultimately consuming thousands of manhours, many federal and DoD agencies have started brokering these GT&Cs at the highest level possible, usually at the headquarters level. Instead of listing discrete services and order amounts, each agency determines an estimated total cost for a 10-year period using historical data and defines the scope to be any goods or services provided by the agency that is within the scope of their mission. This involves taking hundreds to thousands of agreements with the one trading partner and consolidating them into one GT&C. Similar to signing up for Netflix, the user signs one agreement to access the service; that one account provides access to all the titles within the Netflix platform. Likewise, the one GT&C provides “access” to all the goods and services provided by the trading partner. While there are still some gaps to fill by moving to this strategy, the manhours saved and the future benefit of tracking similar costs across the agency with one of its trading partners will be significant; allowing the Army to tackle other strategic priorities and analyze the business taking place to ensure costs savings throughout the agency.

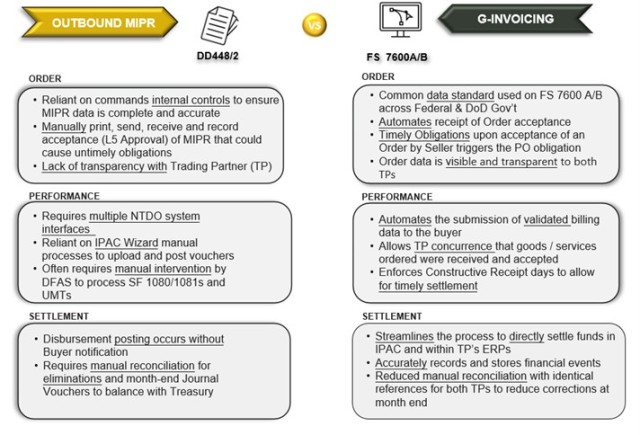

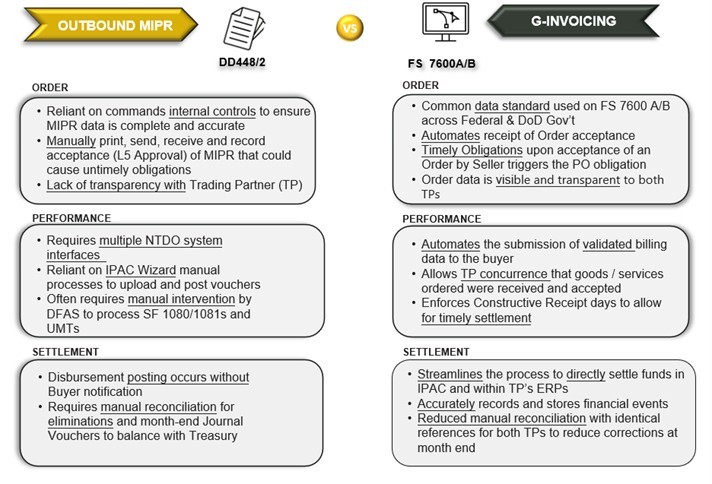

Orders

Similar to Netflix, when signing up for an account, the user picks the plan and cost associated with the plan. This is the specific order documenting what is being purchased. With Netflix an order is documented online and stored within the system. DoD currently documents orders between agencies using a Military Interdepartmental Purchase Request (MIPR). This MIPR form is subsequently emailed back and forth to document the transaction, stored in various locations, and often does not contain the data required to properly document the transaction. In addition, prior to G-Invoicing, there was never a standardized ordering form for business done with federal agencies, resulting in the improper use of MIPRs or the use of inconsistent, locally created forms.

G-Invoicing requires the use of the Federal Intragovernmental Data Standards (FIDS) to document orders to ensure agencies are capturing the correct data. FIDS also provides users the ability to “talk” in a similar language and no longer requires users to try to decode the data and naming conventions of other agencies. The use of the FIDS and the requirement for all orders between government trading partners to pass through G-Invoicing will reduce the volume of unmatched transactions (UMTs) and minimize the timing differences of general ledger postings. These benefits will help the Army and DoD remediate various issues found within the IGT process and eventually help the Army (e.g.) achieve and maintain a favorable audit opinion.

Performance

Back to the Netflix example, one a user is able to access their account and begin watching their favorite show, Netflix bills the user based on the order and terms and conditions previously documented. This revenue recognition and billing process is similar to the G-Invoicing “Performance” step. Once a trading partner has shipped the goods ordered or provided the service and are ready to bill, they will submit a performance transaction. No more waiting until the end of the fiscal year to start billing for services rendered. G-Invoicing will allow trading partners to receive their revenue exponentially faster than they do with today’s current process, which in return increases the buying power of that “seller” agency. G-Invoicing also provides a mechanism to capture the acknowledgment that receipt and acceptance occurred, a major material weakness in the current IGT process faced by all federal and DoD trading partners, and also that the transaction was valid. The performance transaction is the mechanism that initiates the systemic processing of Settlement.

Settlement

When the user completes the Netflix account order, they must add a credit card for billing. That credit card is the mechanism Netflix uses to get the funds owed from the service provided. Similarly, G-Invoicing is the mechanism in which to complete Intragovernmental Payments and Collections (IPAC). This is the process and system used to move funds from the buyers account to the sellers account based on the performance transaction submitted. All of the steps previously completed, from establishing a GT&C with a specific, system-generated identifying number, to documenting orders with use of the FIDS, to finally submitting the performance transaction when ready to bill, will ensure smooth processing of the transaction and accurate recording of the associated general ledger postings. All DoD IPAC will be processed systemically without the need of a third-party intermediary, be recorded within the same accounting period, and have little to no opportunity of erroring due to incomplete or incorrect data.

(See accompanying graphic which provides a summary of the important changes coming with the transition from the current, manual process to G-Invoicing's new, automated process.)

Implementing G-Invoicing will result in numerous changes to how business is conducted between federal and DoD trading partners. Not only does it involve learning a new process and system, but G-Invoicing will require staying in consistent communication with trading partners to ensure both are fully tracking the changes coming with the implementation and each party’s timeline. Like the commercial space where a buyer and seller are both required for a transaction to take place, the same is required for the G-Invoicing implementation. Agencies that communicate openly and often with their trading partners will have the most successful implementations.

“This initiative marks a significant stride in streamlining intragovernmental transactions, fortifying our commitment to accountability and effective communication," said Cabezas.

Implementation Takes a Team

G-Invoicing is a communication tool. It provides a forum for trading partners to communicate, from the start of the ordering process to the end of the settlement process. It was not developed in a vacuum and should not be utilized in a vacuum; it is a tool to assist with the communication expected from a “buyer” to a “seller” and vice versa. And similar to websites or cell phone apps, feedback from users is helping ensure that G-Invoicing is updated to meet the needs of all parties involved.

Over the past three years, Enterprise Resource Planning (ERP) commercial software vendors have partnered with the U.S. Treasury and their users to develop G-Invoicing requirements applicable to all federal agencies. A federal-wide user group was established to discuss common issues found, report them to back to the vendors, and share information amongst agencies who may encounter the same issues. The Army has actively participated with the goal of prioritizing and delivering systems fixes that will allow agencies to implement a standardized and efficient G-Invoicing systems solution.

The Army anticipates going live with its G-Invoicing system implementation in November 2024. Each federal agency has their own implementation timelines. U.S. Treasury and OUSD(C) are closely monitoring all federal and DoD agencies’ development timelines, and any potential delays agencies may experience. The Army will need to meet their trading partners where they are within their transition. Communication is crucial during these transition periods to understand which business process to use when conducting business with each trading partner. From basic communication between buyers and sellers, to the group forum created to document and discuss specific, collective requirements and identify areas of improvement, whether initially or as more users are exposed to the system, this effort requires everyone getting involved to successfully implement such a major change across the U.S. government.

As the Army prepares for G-Invoicing implementation and its modernized processes, we all need to document lessons learned to capture what worked and didn’t. This will allow us to maximize the benefits of G-Invoicing while avoiding or mitigating the things that went off course. G-Invoicing will provide the tools necessary to share information that will improve transaction processing and reporting, creating more efficient operations throughout the government. It will bring about cost reductions, a streamlined interagency agreement process, provide more transparency, improve communications between trading partners, and position us for improvement in our audit environment.

We are stronger together and we can get further faster as a team. The work we do today will impact future users of G-Invoicing and improve financial processes. This work requires consistent collaboration and communication with one another in order to resolve differences in our intragovernmental activity and ensure the U.S. Government and the Army are optimally resourced.

“I am thrilled about this capability and strongly advocate for cross-agency collaboration to harness our collective experiences and lessons learned,” said Robinson. “Together, we are implementing a solution that will ensure the stability and advancement of our Army's financial operations."

Social Sharing