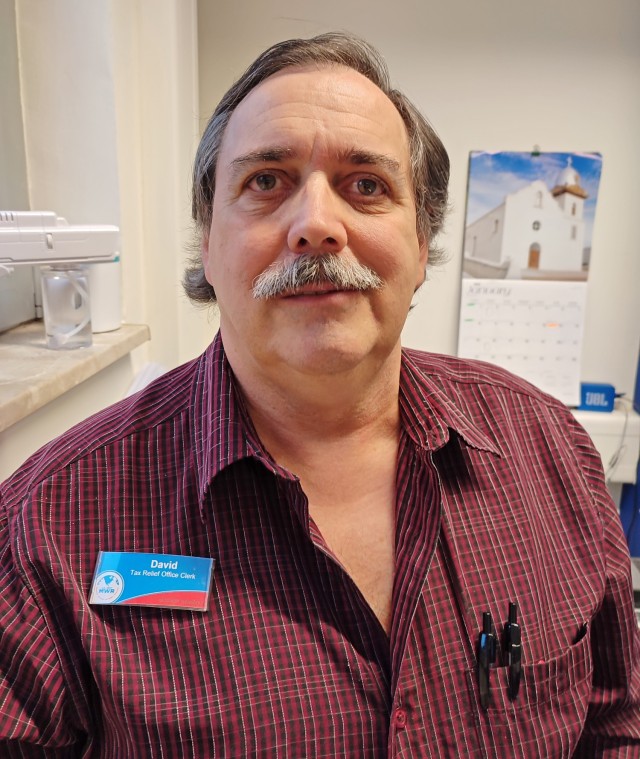

WIESBADEN, Germany - “I like serving the military. It may sound like a cliché, but I like serving those who serve our country,” said David Mills, a Value Added Tax clerk at Wiesbaden’s VAT/UTAP Office on Clay Kaserne.

The military veteran, who has served the Department of Defense in the Army Reserves, on active duty and as a civilian for nearly 38 years, said, “I like to do my part toward the greater effort of serving our country.”

“David always goes above and beyond his VAT clerk duties,” said Rebecca Samsa, VAT/UTAP Office manager. “He basically is our handyman for the VAT office.”

Besides his regular duties helping brief patrons about how to obtain and properly use the German tax avoidance tools, Samsa said that Mills produced and voiced a video to explain the process, cut and hung protective guards for the new office, made file rails for “hand-me-down file cabinets so we could cut costs, made locks and keys and secured our safe. … He continues to update the video (available on the VAT program page of the Wiesbaden.armymwr.com website) with changes.”

“I like the customer contact – being able to help people,” said Mills, comparing it to his former job with the Army Recreation Machine Program. “It’s great being able to help people save money. I find that rewarding.”

The Fort Worth, Texas, native said he began his career in the Army Reserves before transitioning to Active Duty and eventually moving to serve in Germany in 1988. His military experience included serving as a truck driver and later as an instructor with the 37th Transportation Command.

“They didn’t want people coming over here without knowing the rules of the road in Europe,” Mills said, adding that his experience instructing fellow drivers in the military has evolved into now teaching Wiesbaden military community patrons “how to use VAT forms better.”

“We do briefings for Soldiers who are inprocessing that we didn’t do in the past. … Additionally, once we are fully staffed, we plan to also once again offer VAT/UTAP briefings during the Army Community Service Spouse Orientation briefings. … It’s all part of educating Soldiers and families about what we can do for them.”

In the first quarter of this fiscal year, the Wiesbaden office sold some 6,000 VAT forms,” Mills said, explaining that the Wiesbaden office is one of the busiest in Germany.

The married father of two grown-up children said after completing his military career he opted to remain in Europe since his wife is German and wanted to be near her parents. Both his son and daughter are working on careers in Germany.

“I’m looking at splitting time between here and the United States somewhere down the road,” he added.

His advice for community members wanting to use the VAT and UTAP tax relief options while stationed overseas? “Don’t ever be afraid to ask questions. We’re always happy to clarify and answer questions – anything that can help people from making mistakes. It’s always prudent to ask questions.”

(Editor’s note: For more information about the Wiesbaden VAT/UTAP Office located in Building 1052 on Clay Kaserne, call civ 0611-143-548-9107.)

Social Sharing