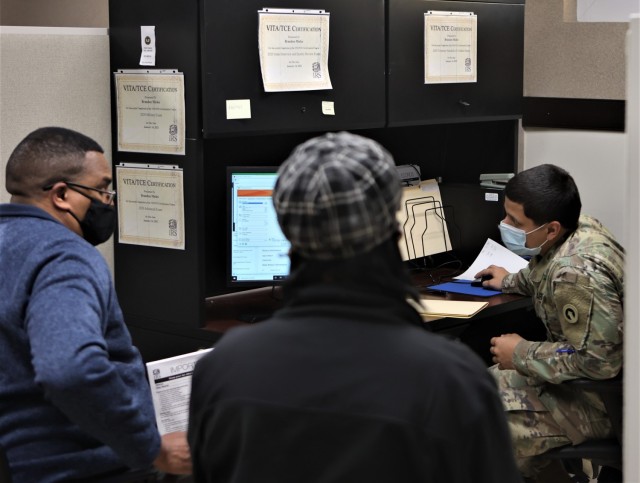

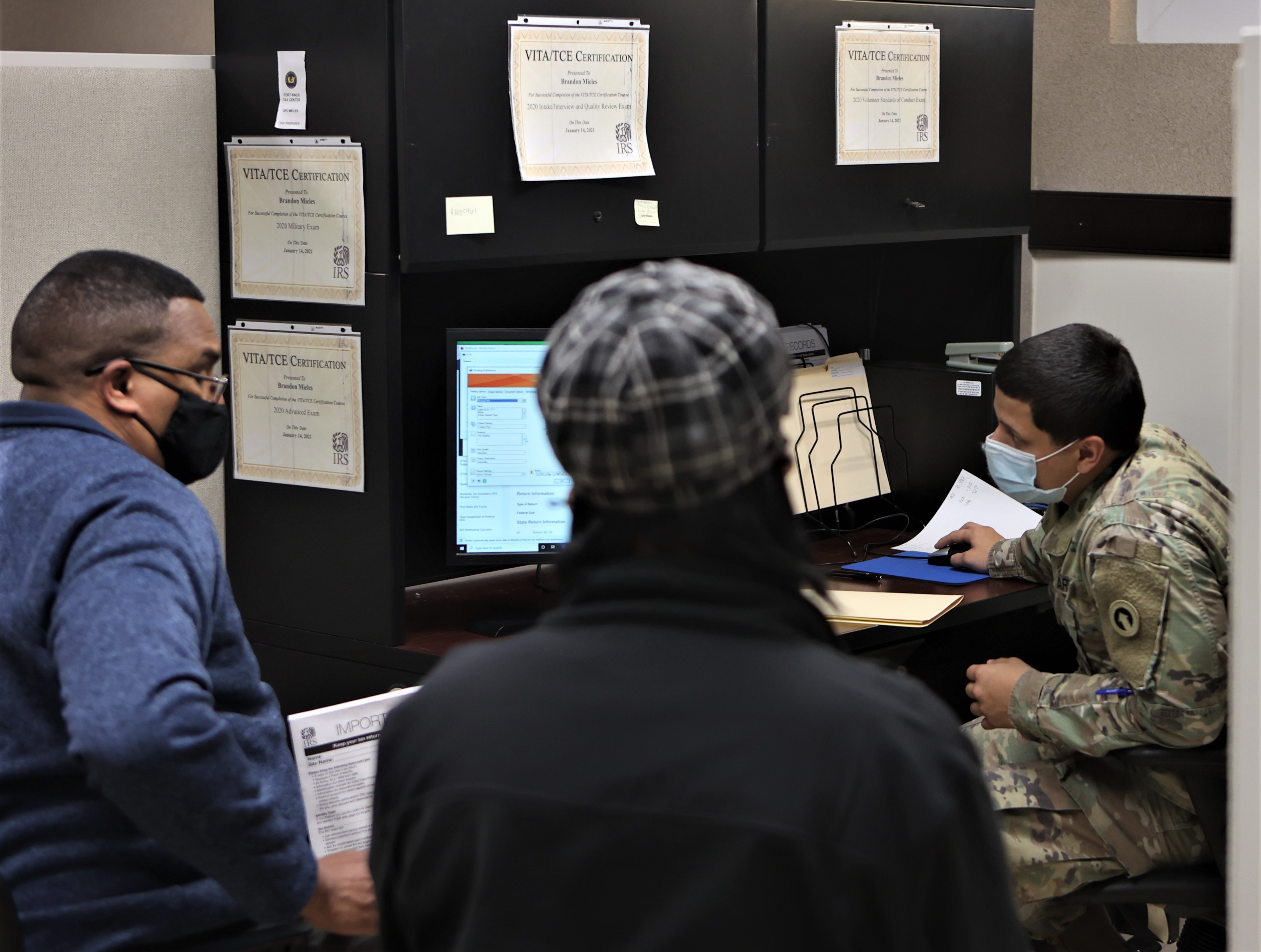

FORT KNOX, Ky. – The Fort Knox Tax Center has prepared over 1,300 returns for the 2020 fiscal year so far, generating over $2 million in tax returns for the community in just over two months.

The center also saved the local military community over $150,000 in fees for those who took advantage of the free service. However, their doors are closing soon, said Weaver:

“Time is running out.”

She explained that though the filing date has been extended to May 17, the tax center can no longer offer extended time blocks.

“We actually do not have any more hour-and-a-half appointments,” said Weaver. “We are now only accepting 30-minute appointments, which consist of basic tax documents.”

This year’s tax season has had an added factor to account for: pandemic stimulus payments. Weaver explained if a taxpayer fails to report the correct number, the amount not received will come back in the form of a federal return.

“This can cause issues if the taxpayer did in fact receive both stimulus [checks],” said Weaver. “This will also slow down their tax returns.”

To determine eligibility or to make an appointment with the Fort Knox Tax Center from now until May 17, call 502-624-0044. The center does not accept walk-ins. Visit the center website HERE for more information.

Social Sharing