CAMP ZAMA, Japan (Oct. 13, 2020) – Sarah Pakizer, a financial counselor with Army Community Service, has made a few potentially high-yield investments of her time at Camp Zama facilities for school-age children and youths here recently.

So far, Pakizer has held two monthly seminars at the Camp Zama Youth Center about money management, and has also provided the Sagamihara Family Area School Age Center with educational materials that have taught children the value of saving.

Although Pakizer primarily serves adults, there is one main reason she gives for stepping up the installation’s financial education outreach to younger consumers: the amount of time they have left in their lives to save, invest and build wealth.

“As teens, you may not have that much money, but you have one thing that’s on your side, and that is time,” she told a group of teens at the Camp Zama Youth Center Oct. 6. The children at the School Age Center, meanwhile, have even more time.

Pakizer’s first seminar at the Camp Zama Youth Center focused on taxes; her second featured information about saving and investing, and she plans to continue to hold the seminars monthly. Most recently, she included information on budgeting, bank accounts, stocks and more, and urged the teens to start saving for retirement as soon as possible.

“The beauty of compound interest is that the benefit of time really allows you to take a little money and have it grow over time,” Pakizer said. “… A little bit of money, saving it and investing it when you’re young, grows exponentially. The longer you wait, the longer you have to save.”

For example, an investment of $136 a month from the ages of 20 to 65 at an interest rate of 7% will yield nearly half a million dollars, Pakizer said.

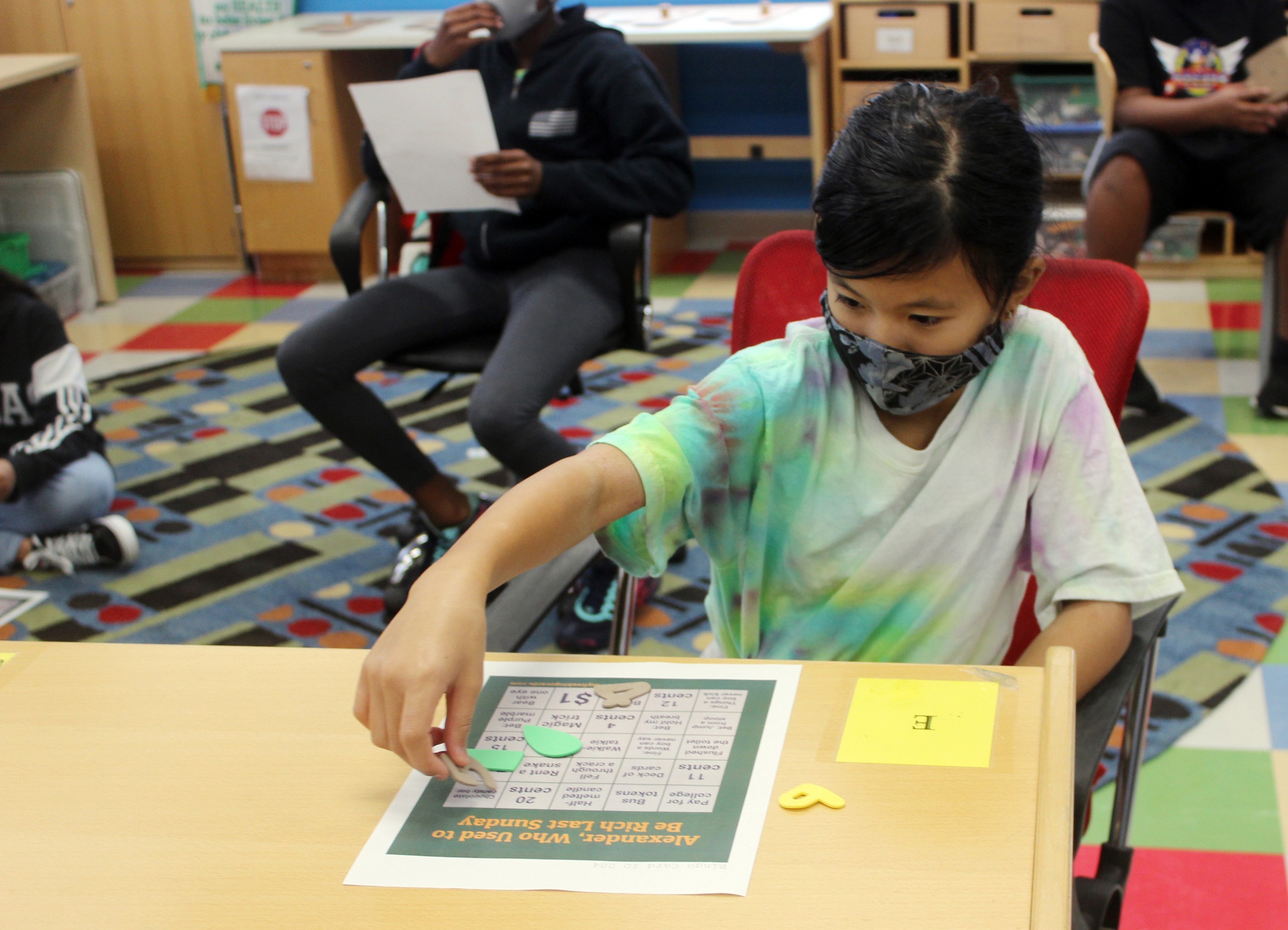

Meanwhile at the SAC, Pakizer provided Michelle Baldwin-Trotter, director of the School Age Center, with materials on money management for younger children, and Baldwin-Trotter presented them Oct. 9. The facility does not allow visitors at this time due to COVID-19 restrictions.

The materials included a copy of the book, “Alexander, Who Used to Be Rich Last Saturday,” as well as bingo cards that help children learn about money management by using phrases from the book and constructing piggy banks.

Baldwin-Trotter said the exercise taught the children, ages 6 through 12, information while also including hands-on activities.

Three sixth graders, Christyna Platt, Derek Smith and Joy Beaver, led a portion of the activities, Baldwin-Trotter said, allowing the group to learn and empowering the older participants to get excited about saving as well.

“It’s really never too early to start teaching children about the importance of saving money,” Baldwin-Trotter said. “This activity was a fun disguise of an important discussion, which was to strategize with the children on ways to practice self-discipline with money.”

Ultimately, the goal was to teach them how to avoid debt, to set aside money for the things they want and need most, and how to “stay focused on the prize” during the process, Baldwin-Trotter said.

Hannah Maza, director of the youth center, said dealing with money is an important life skill, and it fits in perfectly with the center’s mission to keep kids safe, occupied and out of trouble.

The center is affiliated with the Boys and Girls Club of America, Maza said, which promotes sports and recreation, education, the arts, health and wellness, workforce readiness, and character and leadership.

Pakizer’s personal finance classes help the center promote the education and character and leadership portions of their weekly goals, Maza said.

Teens who attended the seminar, which included free pizza and chicken wings, said they enjoyed it and learned a lot.

Brenden Jackson, 15, said his most immediate financial goal is to buy sports equipment, but he also has long-term goals.

“I decided to attend today so I could learn more about saving money to be a billionaire someday,” Jackson said. “I learned that you can save a lot in piggybanks, you can invest stocks—you can do a lot of things. You can do them all together.”

For now, Jackson plans to start saving by mowing lawns and doing chores for his allowance, but looks forward to getting a job when he is old enough.

“I learned a lot about taxes and how much they take for the government,” Jackson said. “In the future, that will be useful.”

Milton Dias, 16, said he attended the seminar because he wants to get better at saving money for the future, and found the presentation very informative, especially when it comes to the stock market and investing.

In addition, Dias said he took note of the fact that Pakizer said all of the notable U.S. billionaires earned their money by starting their own businesses. He also paid fast attention to her retirement advice.

“As soon as you can, you should start saving money, so you won’t regret it later when you get older,” Dias said.

The next seminar will be about credit and debt at 4 p.m. Nov. 17 at the Camp Zama Youth Center, Pakizer said.

Social Sharing