FORT DRUM, N.Y. (Jan. 14, 2019) -- The Fort Drum Legal Assistance Office is helping 10th Mountain Division (LI) Soldiers and other community members get through another tax season with free income tax preparation training.

The class is available to all U.S. Armed Forces ID cardholders from 1 to 3 p.m. and 6 to 8 p.m. every Tuesday, Jan. 29 through April 9, in Room C-134 at Clark Hall.

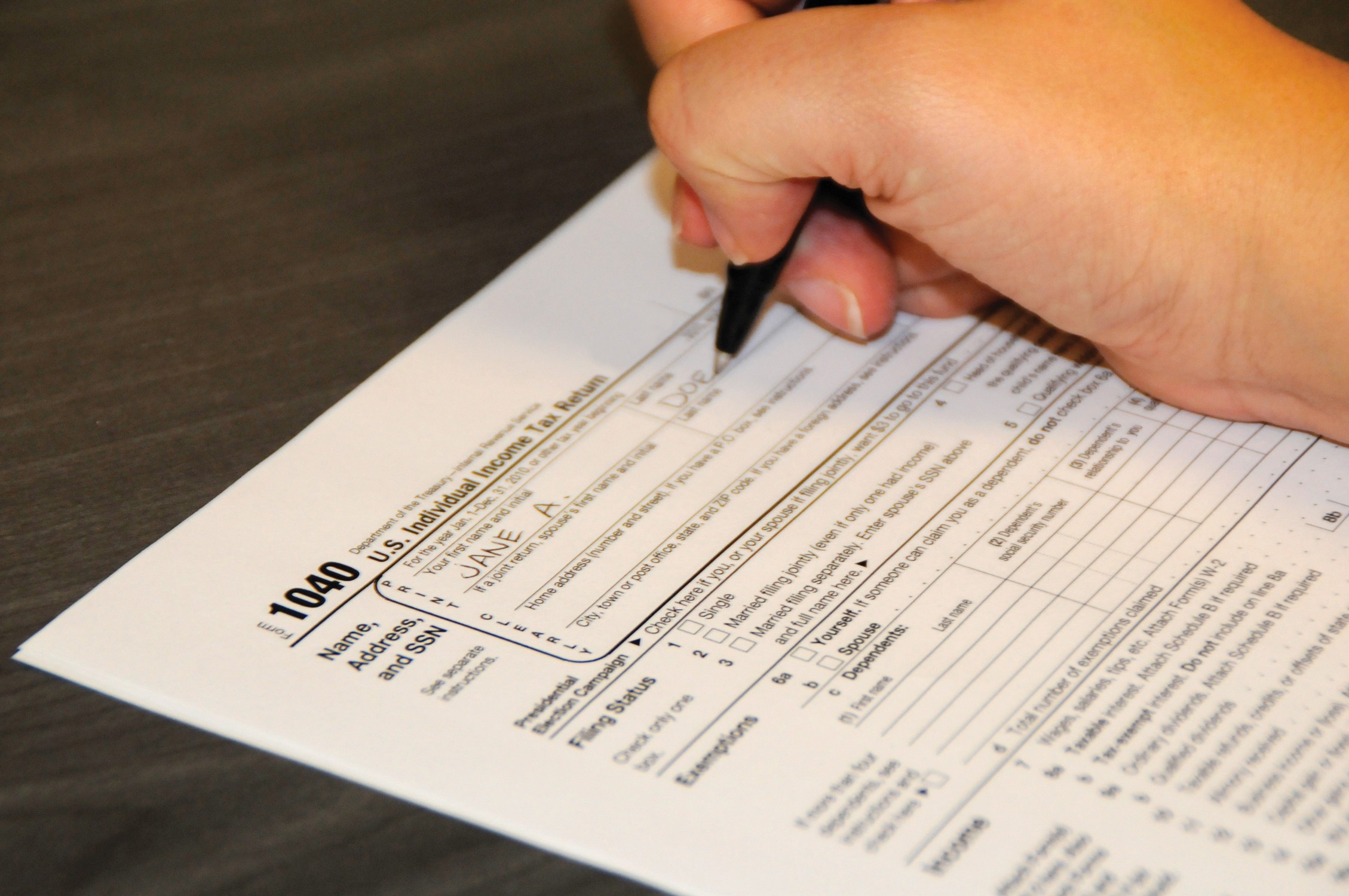

The classroom training is designed primarily for those who have never filed their own tax return before, and attendees will learn basic tax preparation concepts like filing status, personal exemptions, standard deductions versus itemized deductions and tax credits.

"Soldiers who recently joined the Army can benefit from this class, given the unique issues associated with non-taxable income, military moving expenses, changes in residency and deployment," said Capt. Vy Nguyen, a legal assistance attorney and 10th Mountain Division (LI) unit tax advisory program coordinator.

While this class is designed for new tax filers, all service members and their family members, and retirees are welcome to attend.

Nguyen said that the Legal Assistance Office also is trying something new this year by offering facilitated self-assist computer kiosks that community members can use with free tax-filing software to prepare their returns.

"The advantage to using the kiosk is having the staff of legal assistance attorneys here who can help if anyone has questions," she said. "This is available to Soldiers, family members and retirees. If a Soldier wants to set up an appointment, they first have to contact their unit adviser. Everyone else can just give us a call, and we'll arrange it for them."

Dwight Austin, Legal Assistance Office chief, said that they expanded their services this year to accommodate people who may not have access to computers or who are preparing the return alone for the first time.

"A lot of times, people feel fairly confident about preparing their own tax return, but they feel even better if there's someone right there to answer a quick question on whatever they're working on," he said.

The training course is available on a walk-in basis - no registration is required. Kiosk appointments can be made by calling (315) 772-5261, beginning Jan. 31.

"The purpose of our entire program is to empower the Soldiers to learn how to file their tax returns themselves as a life skill," Nguyen said.

Beginning Jan. 28, Soldiers also can seek assistance from unit tax advisers at the battalion and brigade level, who will receive IRS-certified training.

While Fort Drum community members can choose any of these options for assistance, Nguyen said that there are some tax forms that they are not able to assist with - such as private business income (with the exception of Family Child Care providers), foreign income, as well as multiple stock transactions and rental property.

Austin said that there are a number of documents people should bring with them to the kiosk or when meeting with a unit tax adviser. For example, tax preparers are required to bring original Social Security cards for every family member, and New York state residents are required to have their driver's license with them as a form of ID.

As part of the Tax Advisory Program, a legal assistance attorney is available to help prepare returns for Gold Star Families and assist retirees with the preparation of their returns.

To learn more, visit https://home.army.mil/drum/index.php/my-fort/all-services/tax-advisory-program.

Social Sharing