WASHINGTON -- One of the wisest financial choices a Soldier opting-in to Blended Retirement System (BRS) can make is to participate in for the Thrift Savings Plan (TSP), said Henry Manning.

Manning, Operations Officer for the Deputy Assistant Secretary of the Army for Military Personnel and Quality of Life, said that TSP is somewhat like the highly popular 401K plans offered at many civilian jobs, but is actually better.

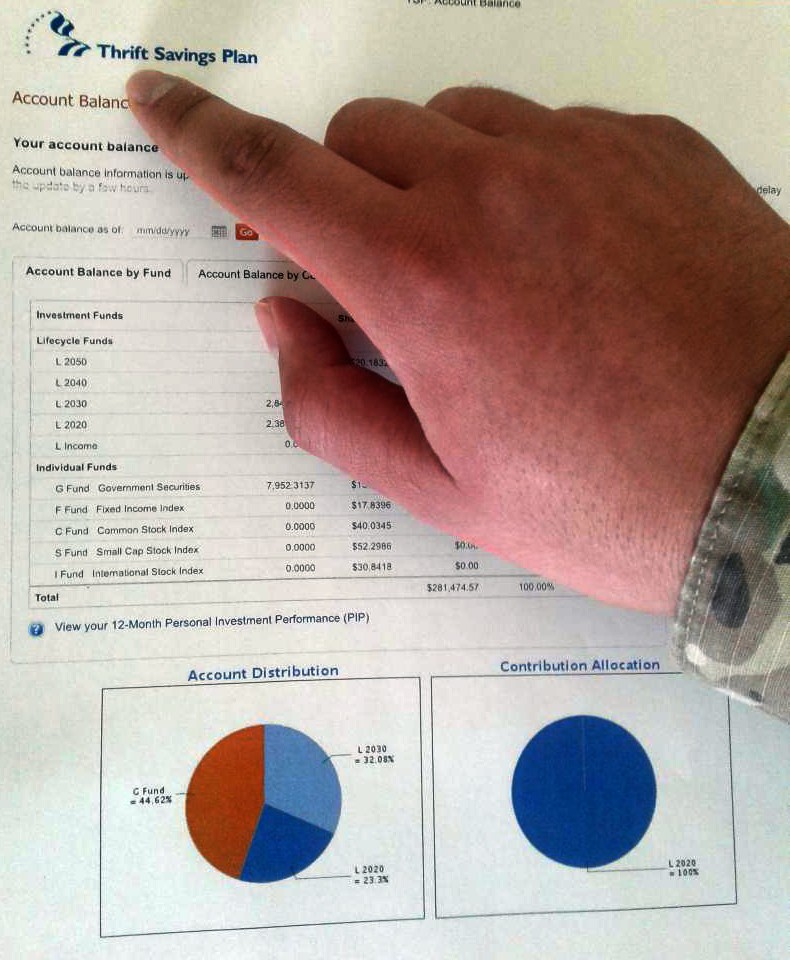

Like the 401K, the TSP is a way for income to grow tax-deferred. The good part about TSP is that unlike some other plans, there are no management fees and TSP contributions reduce taxable income. It has also had a strong performance record over the years.

Perhaps the biggest advantage of TSP is that the government will match a Soldier's contribution, up to 5 percent, he said.

Also, TSP can be customized to meet the Soldier's individual needs, which could be a specified mix of stocks, bonds and/or the more conservative savings fund. He noted that the customization can be altered without penalty at any time.

TSP provides Soldiers separating from the Army prior to becoming retirement eligible with a savings account that is supplemented by DOD contributions and any earnings. Unlike the legacy retirement system, Soldiers leaving after just 2 years can take all associated TSP earnings with them.

Manning disclosed that he has had a TSP account for a number of years and other Army personnel he knows take advantage of it as well.

STEPS TO TAKE

Manning suggested speaking with a Personal Financial Manager at Army Community Service who can help Soldiers customize where their TSP funds are invested.

He emphasized that opting in to TSP isn't automatic. Each Soldier needs to individually enroll and specify the percentage of contribution.

For Soldiers who came in the Army Jan. 1, 2018 or after, the government will match 1 percent of contributions after 60 days of service. After two years, the government will match up to 5 percent of contributions, he said, noting that Soldiers who entered the Army prior to this year can immediately get up to 5 percent matching once they opt-in to BRS and enroll in TSP.

Sgt. Laura Martin, who has a TSP account, showed how easy it is to enroll. She pulled up her MyPay account, which has a TSP option to select with instructions on enrolling either in a traditional TSP, which is tax-deferred, or a Roth TSP, which is not tax-deferred. Martin's husband, also a Soldier, has a TSP account as well. She said the two of them took out a TSP loan, which is interest free, to pay cash for a house they intend to live in upon retirement.

Manning concluded: the vast majority of Soldiers do not stay in for 20 years to take advantage of a traditional retirement pension. That's why enrolling in TSP makes perfect sense.

(Follow David Vergun on Twitter: @vergunARNEWS)

Social Sharing