FORT SILL, Okla. (Jan. 18, 2018) -- Many Americans dread this time of year and with seemingly good reasons.

Welcome to tax season -- the time between Jan. 1 to mid April. This year, however, most Americans will see more money in their paychecks.

The wealthiest 1 percent of Americans pay the most in taxes, so tax reduction will likely be the biggest relief for them. Still, income tax reductions should benefit all Americans to some degree.

Most active-duty service members, retirees and their family members don't have much to worry about with President Donald Trump and Congress' tax plan. That will affect 2018's income tax filing next year. President Barack Obama's Affordable Health Care Act also won't affect too many in the military community other than service members who initially join but have several months' wait until they attend basic training and who had no health insurance before enlisting.

The Fort Sill Installation Tax Assistance Center (ITAC) may not make tax season fun, but it can make it less painful.

Major changes this year include: a militarywide data base that can pull up previous years' tax returns from installations worldwide, making it easier to file rather than remembering to bring in previous years' tax returns.

WHAT TO BRING

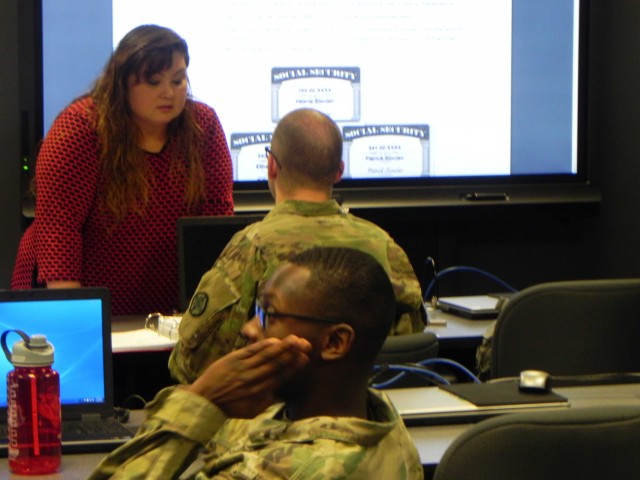

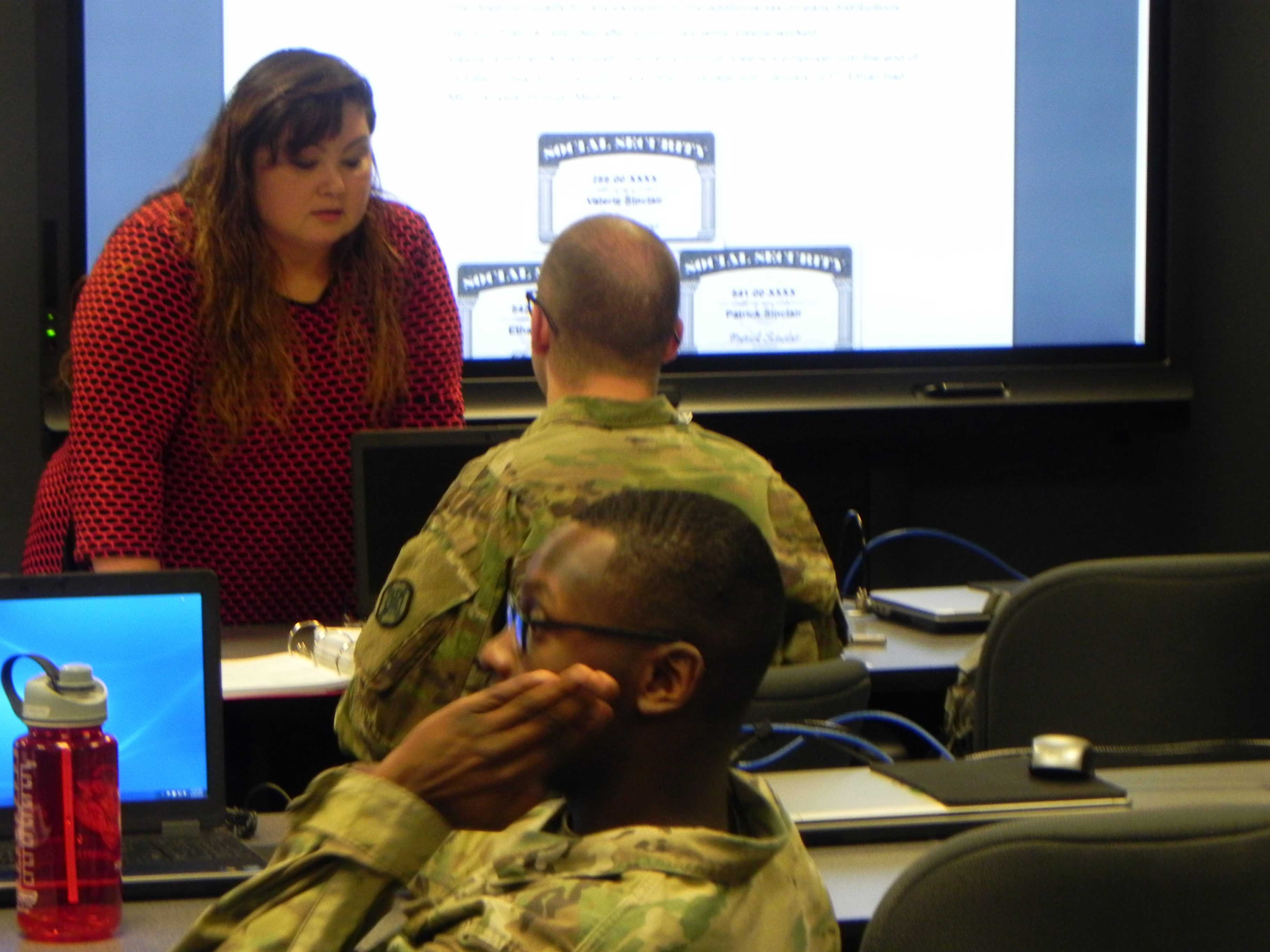

As copied from the Fort Sill tax website at www.army.mil /usag/jag/itac.html, service members, retirees and their family members who live in this area need to bring the following:

- Military ID card (for both if joint return)

- Social Security cards for everyone listed on the return

- All documents showing income received and/or taxes paid

(For example: W-2, 1099R, 1099INT, 1099MISC, 1099G)

- Last year's return, especially for those who had rental income

- Proof of bank account and routing number (cancelled check, last year's return), if they want direct deposit.

People should also bring accurate amounts or receipts for: (all that apply to you)

- Child and dependent care

- Tuition and book expenses

- Student loan interest

- Moving expenses

- Educator expenses

- Charitable contributions

- Significant medical expenses

- Contributions to an Individual Retirement Account (IRA)

- Mortgage interest/real estate taxes (Form 1098)-n If purchased a new home a signed Housing and Urban Development Form 1, orders if purchased with extension for deployed Soldiers, or known as closing documents.

If you are married and/or have dependents:

- Social Security Card and accurate Social Security Number (SSN) and date of birth of all dependents

- Power of attorney. If filing married filing joint and spouse will not be present to sign. This must be the original power of attorney

- If married filing separate, you must have spouse's SSN in order to electronically file.

Further, those who may dread filing taxes, may find reassurance in the fact that the preparers are experienced.

The culmination of our experience is the most we've had of any previous years, said Sheila Olsen, ITAC director.

Olsen, a retired service member, has 19 years' experience preparing taxes at military installations. Rose Mary Bazor, Volunteer of the Year for Fort Sill in 2017, has 25 years' experience.

The officer in charge of ITAC, Capt. Laney Comer, is beginning her fourth year. Her regular job is Fires Center of Excellence, judge advocate general attorney.

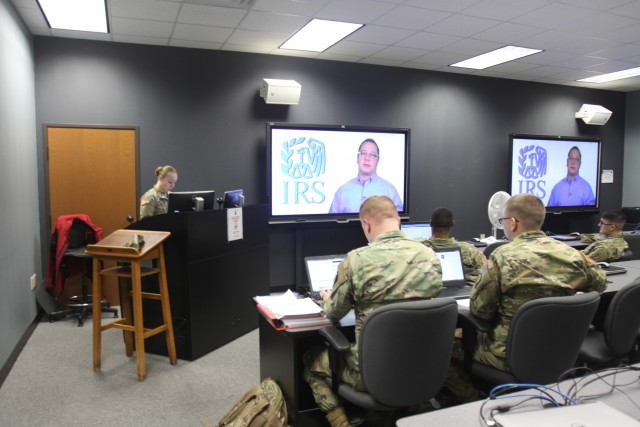

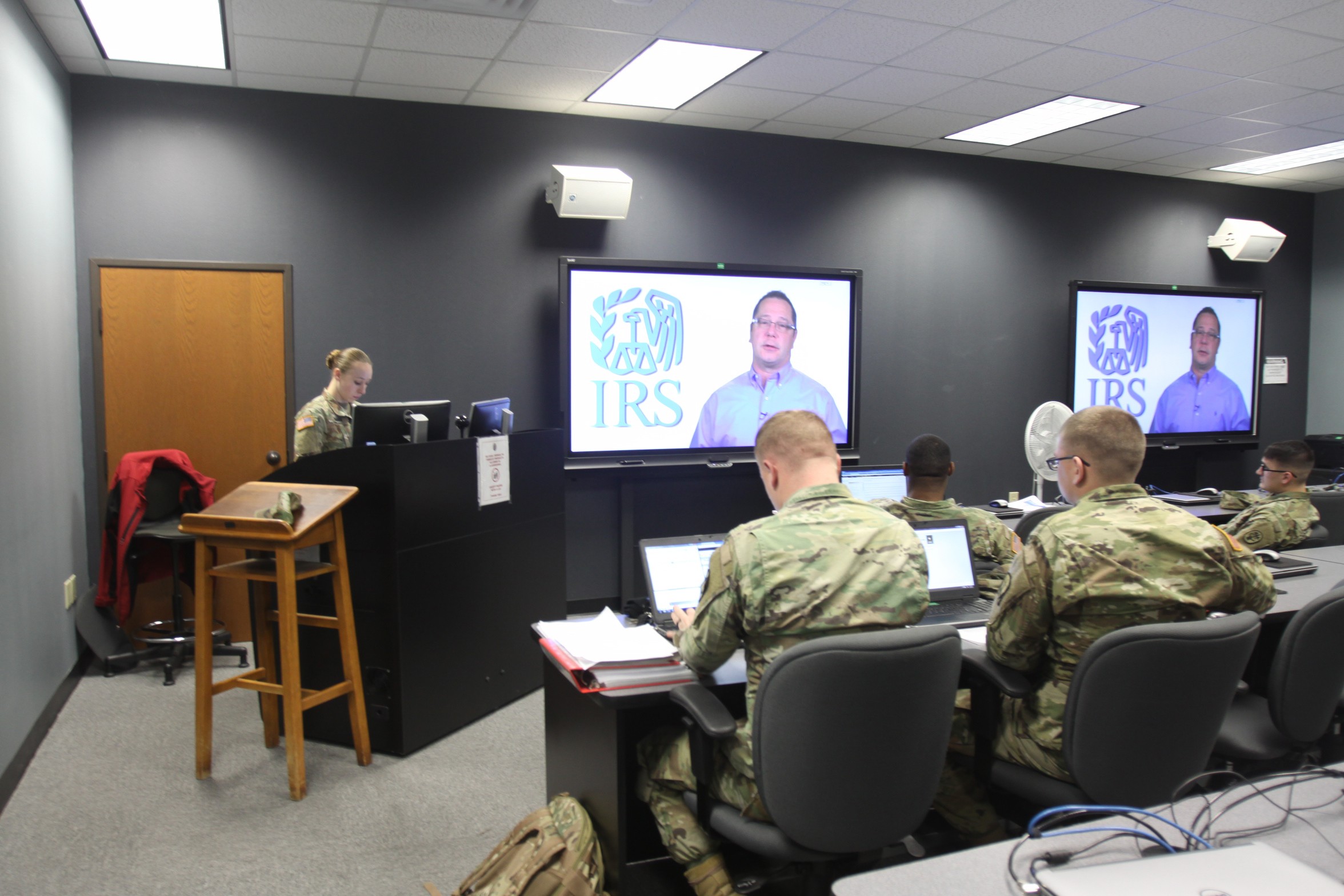

The ITAC Soldiers are borrowed manpower, and the center has roughly 20 volunteers doing taxes this year, she said. Volunteers at the ITAC may earn valuable job experience for future ventures.

"It provides these Soldiers with the skill that they'll be able to maintain even after their military service," Olsen said. "Some of them go on to volunteer or move into the career field. I have had Soldiers from prior years where I've done letters of recommendation if they got out of the military, and now they're professional tax preparers. A few others end up going back to school and major in accounting."

Olsen went on to explain the tax package Trump signed into law last month, which provides generous tax cuts for corporations and the wealthiest Americans, and more modest reductions for middle- and low-income individuals and families.

"Not much of the tax reform bill that was passed will affect this current tax season. It's more going to reflect the 2018 tax season," she said.

Olsen cautioned members of the Fort Sill community who intend to file taxes early through a franchise or do-it-yourself computer software programs.

For junior enlisted service members primarily, it would not be advantageous to them to prematurely do their tax returns prior to Jan. 29, she said. " If they do choose to do so, they're going to one of these franchises where they're going to more or less have to pay for that service, Olsen said.

And that refund is in essence a "rapid refund anticipation loan," essentially meaning that service members pay for state income taxes to be filed, and if there are any mistakes discovered later, service members may pay additional fees to fix those mistakes.

Another tax implication question that service members and others may ask when filing this year pertains to the Affordable Health Care Act. This year everything still stays the same, Olsen said.

"Those active duty in the military having TRICARE are essentially covered, so that doesn't affect them. The type of Soldier population who this would affect are those newly coming into the military, and if they did not have coverage prior to their entry," she said. "If they were not covered the first seven months of the year, that's going to be prorated; that's going to be the first seven months that they're penalized because that's the date that they entered. Those who are ETSing are carried; they get TRICARE Standard, and that meets general minimal essential coverage, so they're fine there, too."

VITA TRAINING

Olsen also pointed out that last year was the second year the IRS provided VITA software Tax Slayer, which is the Volunteer Income Tax Assistance software.

"There is a new proponent to it where the tax payers can tell us if they want this return to be concurrent, meaning (that) in previous years if they went from duty station to duty station they would have to physically bring a copy of their tax return. We (did) not have a cloud or a data base where we could pull their previous return where they could go to the IRS to get a transcript. Now what happens is we annotate that on their return, and it does go to that cloud, that data base.

"Let's say their next duty station is at Fort Bragg and they go to the VITA site there, they'll be able to pull the return we did here."

She further explained that prior to last year, the ITAC had another software program that was incompatible to VITA. The two programs did not "talk" to each other.

Originally VITA was for lower income and the elderly who are in the underserved population that would need this free tax service.

The military proponent opens it up where income isn't technically a factor, explained Olsen. "You're qualifying factor is if you're entitled to services under Army Regulation 27-3, the Legal Assistance Program. You would need to be active duty, retiree with a blue ID card and their dependants, or you could be a Reservist or National Guardsman on Title 10."

All returns with property rentals and Schedules C of a standard 1040 form, "Profit or Loss for Business" (for home-based businesses, such as Avon or Scensty) will usually be prepared by appointment only, especially if actual income exceeds $600 after expenses.

"The law says $600 in profit they must release. If you have made at least $600 in commission they have to release it," Olsen said. "For those who are not sure, "Look on a traditional C form (1040) and you'll know your expenses."

She elaborated: home-based business owners can subtract advertising costs, supplies, upkeep of a website if one had to pay for upkeep, and personal vehicle use, among other things.

"Other than that you would be precluded from doing your tax return at the VITA site if you carried inventory. If you did not carry inventory, we could do your Schedule C.

Some people who have home-based businesses don't keep records , and the tax staff wants to air on the side of safety and to protect its reputation," said Olsen. She will sometimes make an exception to policy for those business owners. It's best to call for an appointment.

Jan. 29 is the grand opening of the ITAC, and it marks the first day of business. It also marks the first day the IRS accepts electronic returns. At press time, the Defense, Finance and Accounting Service or DFAS was scheduled to release W2s Jan. 20.

Hours vary slightly from last year. Olsen elaborated.

"We understand that we've cut it an hour short this year," Olsen said. "That's because if we had both waiting rooms full of people at 1700 (5 p.m.) we weren't getting out of there until 2000 (8 p.m.). "If they are worried because they are married filing joint and they didn't have child care, we will have appointments on Saturday instead of walk-ins, so they have an opportunity to get serviced instead of walk-ins. Our Saturday hours will be by appointment only and we will be open from 9 to 3. The last appointment is at 1:30.

"For those who want the convenience of an appointment because they don't want to wait to be seen, on a first come, first serve basis, we will have appointments available literally six days a week. The appointment line will go live to where we can have it manned will be as early as Monday, (Jan. 22)," said Olsen.

Core hours are Mondays through Fridays from 9 a.m. to 4 p.m.

"So anyone who signs in by 4 will be serviced even if they're sitting in the waiting room," Olsen said.

Additional notes include:

"We also offer a single Soldier drop off program and what this is, it's more geared for those in training, whether it's basic, AIT (advanced individual training) or whatever training they happen to be here and they're short on time. All they would need to do is fill out the single Soldier drop off sheet with their W2 and we will do their return and they can pick it off and sign at their convenience."

Spc. Adam Dougherty, 3rd Battalion, 13th Field Artillery, was selected for the tax assignment. He said he finds the hardest part of being a volunteer tax preparer is remembering all the details, but they have plenty of experienced preparers, and reference materials available to consult.

ITAC

The ITAC is at the Fort Sill Welcome Center, 4700 Mow-Way Road, Suite 400. Its telephone number is 580-442-6445. It is open Jan. 29 through April 16. The deadline for filing taxes in 2018 is April 17, but their office will be closed that day to ensure packets they've submitted are processed before the deadline.

Weekday operating hours are 9 a.m. to 4 p.m. Saturday operating hours are 9 a.m. to 3 p.m. The center is open on Saturdays from Feb. 3 to March 31 only. Customers may schedule appointments or walk in. If signed in by 4 p.m., they will be seen that day.

Olsen said she was grateful that the units provided Soldiers because without them and other the volunteers, the ITAC wouldn't exist.

"They put in a lot of hard work to become certified. The training is intense; it's not so easy that anyone can do it. It is time consuming as well," she said.

Social Sharing