Basic Allowance for Housing (BAH)

By SFC Jason L. Hatt and CPT Eric A. Rudie

During the finance portion of inprocessing, each Soldier must recertify entitlement to BAH regardless of dependency status. The certification process begins with a DA Form 5960. This supporting document allows the Finance office to make any necessary changes to BAH including initiating a start, stoppage, or location change. In addition to this document, the Soldier may have to provide proof of support or residence for their dependents. Although, each situation is unique, most Soldiers in Korea will fall into one of the scenarios below:

Single Soldiers with No Dependents

Soldiers in the barracks receive a non-locality based Partial BAH. For a PFC, this equates to $7.80 a month. Single Soldiers authorized to reside off post receive an Overseas Housing Allowance (OHA) which does not have the same rules as BAH, though may be categorized the same on the LES.

Non-Custodial Parent

Soldiers who DO NOT have court decreed primary legal and physical custody of their children generally receive BAH-Diff. BAH-Diff is the difference between with and without-dependent non-locality BAH rate in a given calendar year. A member must be able to demonstrate that they contribute no less than the applicable BAH-Diff rate to retain the allowance, but it is not required for a legal document to state support or responsibility to support in order to be eligible for BAH-Diff. Single Soldiers residing off post and pay child support, will ONLY receive the with-dependent utility allowance for OHA in lieu of BAH-Diff. A link to allowance rates is provided on the next page.

Unaccompanied Tours

Soldiers who elect to leave their family at the losing duty station or relocate their family to a designated place CONUS are generally authorized BAH at the with dependent rate. If the family does NOT relocate, then BAH remains tied to the rate of the last duty station. It does not revert to the dependents actual zip code unless they relocate. If dependents relocate to a designated location during the transition period of the PCS, then the effective date of BAH for that locality will be the Soldier's date of arrival in Korea.

Early Return of Command Sponsored Dependents

Soldiers must seek 8th Army G1 approval for Early Return of Dependents (EROD) requests. The 8th Army G1 Command Sponsorship Program section will validate all requests. Housing allowances for dependents who return early are authorized only with an approved EROD. See your servicing S1 for more information.

Don't Let Greed End Your Career!

Fraud is a serious issue here in Korea, and is vigorously investigated and prosecuted. DFAS routinely audits suspicious cases and will meticulously comb through years of records to collect back every cent. Audits often reveal a long history of fraudulent BAH claims. In the past year alone, several other officers and senior NCOs were prosecuted and convicted for fraud. Sentences have included confinement, reduction, fines, and reprimands.

A senior NCO is currently in confinement on peninsula for stealing $90,000 in BAH. Additionally, the NCO was reduced from E-8 to E-4. Other recent examples include a LTC who was convicted in November 2015 of stealing $40,000 of BAH, FSA, and COLA. He was reprimanded and fined $20,000. In March 2016, an E-9 was convicted of fraudulently claiming $1,200 of travel pay for dependents. He was reprimanded and required to repay over $50,000 in erroneously paid allowances. That same month an E-7 was convicted of stealing $70,000 of BAH. He was reprimanded and confined for four months. In April 2016, an E-7 was convicted of stealing $20,000 of BAH and travel pay. He was reduced to E-6 and confined for 60 days.

Each verdict is a federal conviction that will follow them for the rest of their lives and have a devastating impact on retirement and future earnings. Don't let the temptation to commit fraud affect your family, career, and reputation. See your servicing finance detachment if you have any questions.

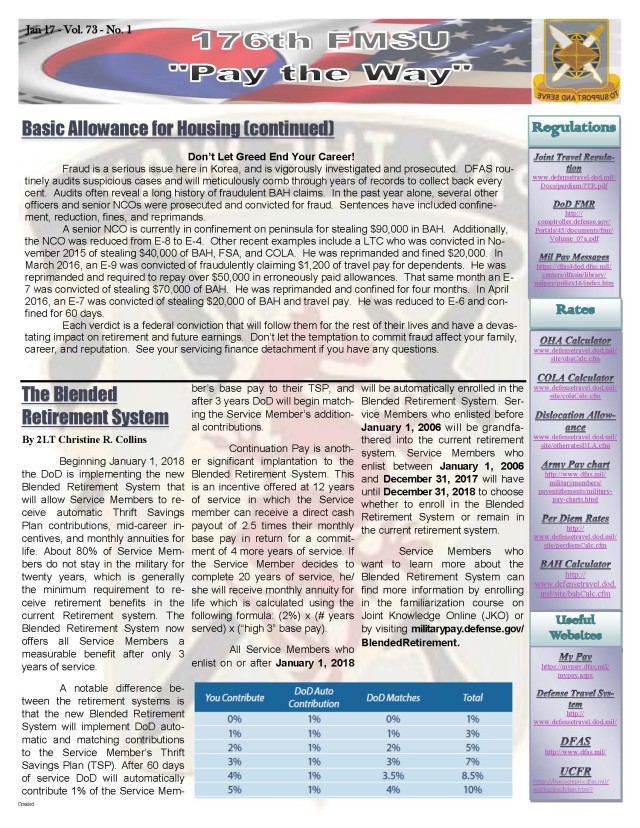

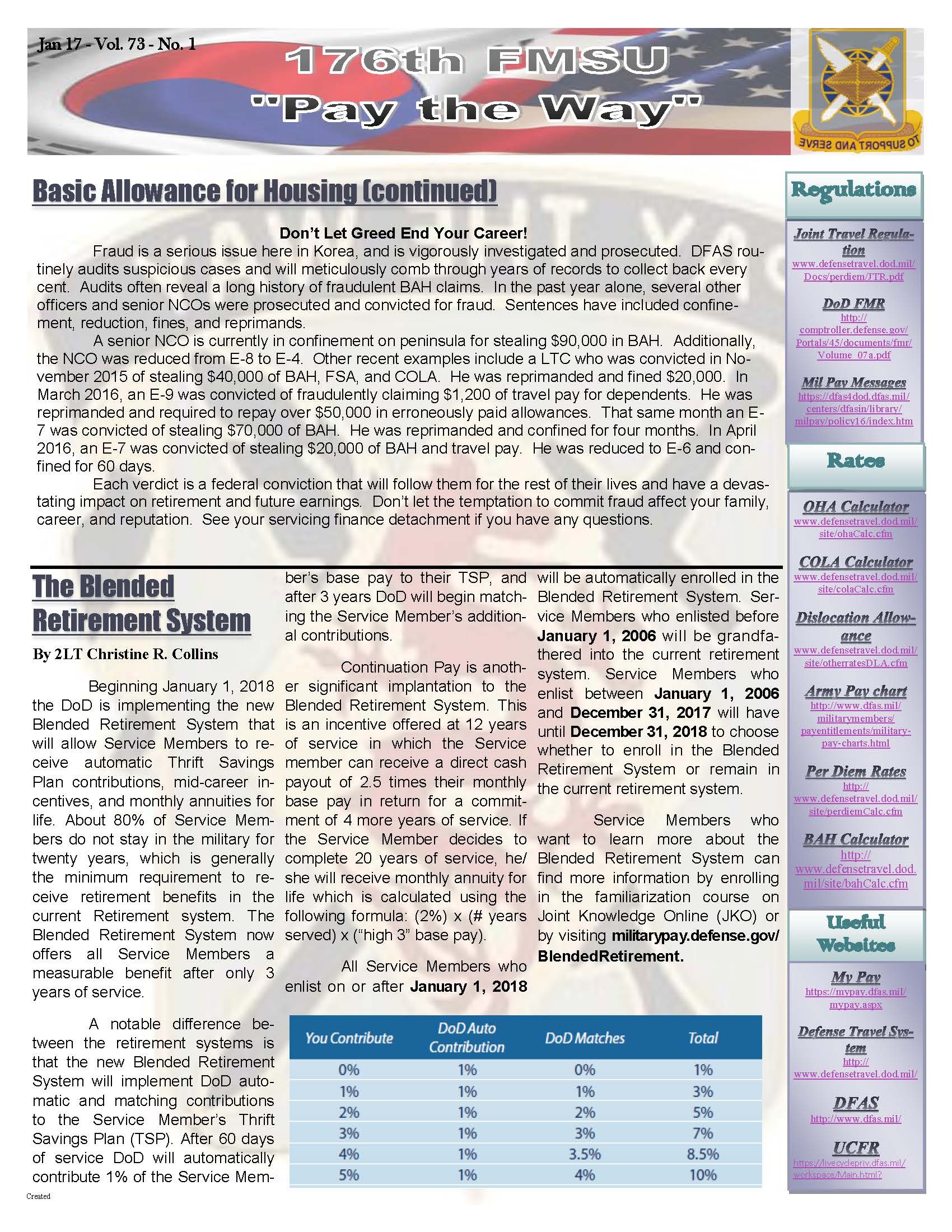

The Blended Retirement System

By 2LT Christine R. Collins

Beginning January 1, 2018 the DoD is implementing the new Blended Retirement System that will allow Service Members to receive automatic Thrift Savings Plan contributions, mid-career incentives, and monthly annuities for life. About 80% of Service Members do not stay in the military for twenty years, which is generally the minimum requirement to receive retirement benefits in the current Retirement system. The Blended Retirement System now offers all Service Members a measurable benefit after only 3 years of service.

A notable difference between the retirement systems is that the new Blended Retirement System will implement DoD automatic and matching contributions to the Service Member's Thrift Savings Plan (TSP). After 60 days of service DoD will automatically contribute 1% of the Service Member's base pay to their TSP, and after 3 years DoD will begin match-ing the Service Member's additional contributions.

Continuation Pay is another significant implantation to the Blended Retirement System. This is an incentive offered at 12 years of service in which the Service member can receive a direct cash payout of 2.5 times their monthly base pay in return for a commitment of 4 more years of service. If the Service Member decides to complete 20 years of service, he/she will receive monthly annuity for life which is calculated using the following formula: (2%) x (# years served) x ("high 3" base pay).

All Service Members who enlist on or after January 1, 2018 will be automatically enrolled in the Blended Retirement System. Service Members who enlisted before January 1, 2006 will be grandfathered into the current retirement system. Service Members who enlist between January 1, 2006 and December 31, 2017 will have until December 31, 2018 to choose whether to enroll in the Blended Retirement System or remain in the current retirement system.

Service Members who want to learn more about the Blended Retirement System can find more information by enrolling in the familiarization course on Joint Knowledge Online (JKO) or by visiting militarypay.defense.gov/BlendedRetirement.

Related Documents:

Finances in the ROK [PDF]

Social Sharing