"The universe never did make sense; I suspect it was built on government contract."

--Robert A. Heinlein

Government contracting is indeed a complicated and, at times, perplexing business. It's an arena governed by the massive Federal Acquisition Regulation, where lack of knowledge and failure to perform due diligence can significantly increase the government's exposure to cost and performance risks. Imagine you're building a house and you ask the general contractor how many subcontracts he had open, which companies held them, what type of work the subcontractors were performing and how he would assess the quality of their work. Now imagine his or her response to those questions is, "I'm not really sure."

That's similar to where the U.S. Army Sustainment Command (ASC) found itself at a command level in October 2010, when the U.S. Army Installation Management Command Directorates of Logistics, now known as Logistics Readiness Centers (LRCs), were placed under operational control of the U.S. Army Materiel Command, ultimately being reassigned in October 2012. This significantly changed the culture of ASC, as contracted services became a major component of ASC's logistics capability; today ASC has more than 350 services contracts worth nearly $1 billion in annual spending--about half of ASC's budget.

Directly following the transition, services contracts were generally decentralized down to the LRC at each installation and there was no comprehensive command-level oversight and management of contracted services from a portfolio management perspective. Considered common practice at the time, this structure reflected larger issues across the entire DOD. As recently as May 2015, a U.S. Army Audit Agency report stated: "Army leaders had no reliable means of knowing how many service contracts had been awarded for the Army or the value of those contracts." It's not a huge leap to infer from this statement that this lack of visibility brings with it inherent waste, and that opportunities exist to achieve significant savings.

'SERVICES CONTRACTING A TEAM SPORT'

Instructors at the Defense Acquisition University (DAU) are fond of saying, "Services contracting is a team sport," one that involves all stakeholders. During the initial phase of assuming responsibility of the LRCs, the newly assembled ASC stakeholders were not functioning as a team. Complicating factors included the geographical dispersion of the LRCs and the diversity and geographical dispersion of supporting contracting agencies. Additionally, as has been documented in several audits, Army commands responsible for the organizations generating the requirements for services contracts had neither the automated tools nor the business skills to take on the task of managing services contracts throughout their life cycle.

With a desire to gain visibility of all service contracts at the command level to enable program management, and considering the lack of an Army enterprise business intelligence tool that could manage this type of information, ASC realized it had to help itself, and help itself fast. The first step was to build an inventory of services contracts, establish processes to review and approve requirements and then create automated tools to support these processes. Historically, DOD had seen services contracts as enablers in fulfilling operational requirements, and not as something in their own right, and as a result there were no automation systems in place to track them outside of the contracting community.

ESTABLISHING THE DATABASE

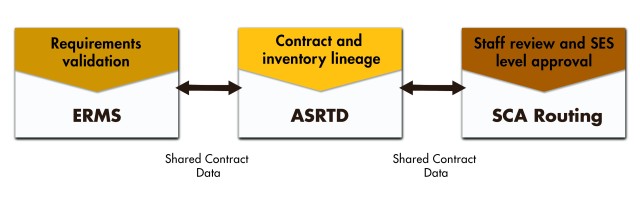

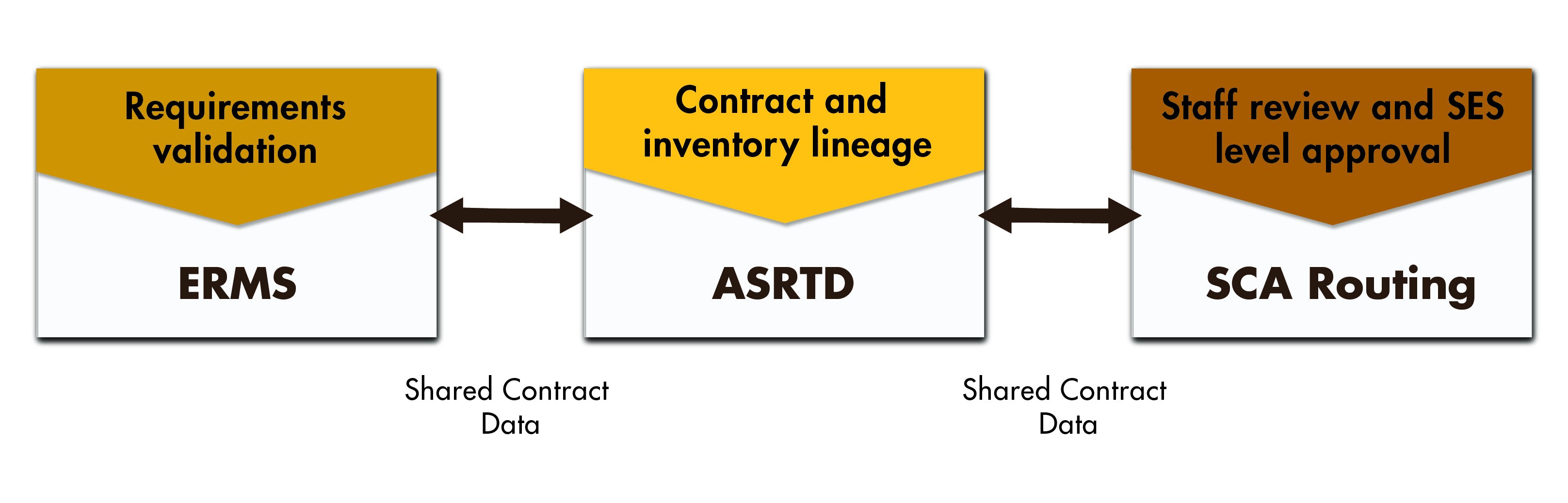

Out of necessity, ASC developed the Enterprise Requirements Management System (ERMS), the ASC Service Requirements Tracking Database (ASRTD) and the Services Contract Approval (SCA) Routing. ERMS is an automated tool that facilitates requirements validation and creates a detailed record of services requirements for the current budget year. ASRTD maintains a record of current and closed contracts, creating a historical lineage of contracts to requirements and the forecast life cycle based on programmed periods of performance. SCA Routing is an automated staffing and approval tool to process the request for services contract approval form, which also shares data with ASRTD. (See Figure 1.)

Once ASC was able to track services contracts, leaders wanted to put together a team with the skills to use that data to develop efficiencies and control costs. The goal was to develop the business skills needed to review and improve acquisition strategies in coordination with contracting partners, and then ensure contractor performance after a contract was awarded. To develop the requisite skills, ASC established the Installation Logistics Division, a staff element that could actively manage the LRC's services requirements by commodity through the service acquisition life cycle. ASC also established the Contract Management Office (CMO) to serve as a bridge between the requiring activities and the contracting agencies. In coordination with this action, the Army established the position of portfolio manager for logistics management services in ASC headquarters as part of its horizontal governance structure; that function was also placed in the CMO. With those changes, ASC had the structure in place to initiate continuous improvement in services contracts management.

One of the first significant efforts at improving the efficiency of services contracts was using a portfolio approach to establish the Enhanced Army Global Logistics Enterprise (EAGLE) basic ordering agreement, a contract vehicle created to set up a single logistics provider for all supply, maintenance and transportation requirements on an Army installation or joint base. The acquisition strategy was approved in February 2012 and the first task order was awarded in August 2013.

Following the successful launch of EAGLE, ASC then began to focus on improvements in the contract pre-award phase, specifically on standardizing performance work statements (PWS) and quality assurance surveillance plans (QASP) for each commodity of logistics services. ASC sought the support of DAU, using the DAU Service Acquisition Workshop, where DAU instructors facilitate PWS and QASP development, and the DAU Acquisition Requirements Roadmap Tool Suite, a "how-to" guide to effectively managing services requirements--a sort of "Services Acquisition for Dummies"--to develop and refine these products. To further increase competition and productivity and improve market research, ASC also expanded the use of industry days, small business symposiums and advance planning briefings for industry. Finally, to tie all these efforts together, ASC established a business process where all services requirements with a total value above $200,000 are reviewed by an acquisition strategy review board made up of members of the Senior Executive Service from ASC and the U.S. Army Contracting Command (ACC). There, a multifunctional team from the requirements and contracting community works to develop and present an acquisition strategy to the board for approval.

ASC's most recent initiatives focus on contract post-award activities, primarily monitoring costs and contractor performance. To accomplish this, ASC has begun conducting a quarterly contract management review, or CMR. The CMR is an open forum that allows the ASC commanding general to review the services contract inventory and discuss service contract performance with the headquarters staff, Army field support brigade (AFSB) commanders and supporting commanders and managers from ACC. As part of this review, the activity responsible for each services requirement assesses each contract using cost, schedule and performance as evaluation metrics. Subsequently, each AFSB then selects two to three contracts to undergo a "deep dive" review, which they brief to the ASC commanding general. As part of this review, contracting officer's representatives' surveillance activities and ratings of contractor performance are reviewed. Positive or negative trends are identified and then addressed if necessary, making the command more responsive to situations where a contract may be veering off course. Finally, to spread best practices across the command and to identify potential pitfalls, each commander or responsible manager is given the opportunity to share lessons learned with their peers. The CMR is already paying dividends, as it has renewed focus on the importance of post-award surveillance activities and documenting contractor performance throughout the command.

CONCLUSION

As ASC moves forward in an environment where resources are constrained but customers continue to expect the same level of quality logistics services, the command plans to build on the successes achieved over the past four years. EAGLE will remain one of ASC's largest programs; to date the program has awarded 30 task orders totaling $1.8 billion--generating a cost avoidance savings of 19 percent--and reduced the number of duplicative contracts by 56 percent. ASC plans to complete the remaining 16 EAGLE task orders by FY18 for a total value of approximately $4.5 billion, which will generate additional cost avoidance savings. Other future efforts will focus on driving down costs through better cost analysis and management, following the DOD lead to reduce duplicative contracts through use of strategic sourcing, and continuing to implement Better Buying Power initiatives on future contracts. Contracted services will remain an integral part of the way ASC provides sustainment to the Army. Improving the business skills to be able to effectively partner with ACC and achieve best value for the government will be critical to continued success.

____

This article will be printed in the October - December 2016 issue of Army AL&T magazine.

Social Sharing