Pentagon officials are full-court pressed to educate both active duty service members and reservists on a new era of self-investment with the Blended Retirement System, what officials call a "modernized retirement plan," that goes into effect Jan. 1, 2018.

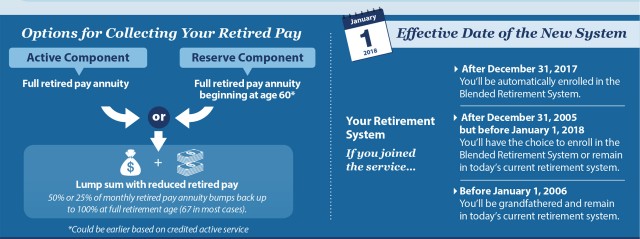

Service members who joined the military after Dec. 31, 2017, will automatically be enrolled and receive matching Thrift Savings Plan contributions; members who joined the military between Dec.31, 2005, but before Jan. 1, 2018, can opt to enroll or stay in the current retirement system.

Service members who joined the military before Jan. 1, 2006, will be grandfathered and remain in the current retirement system.

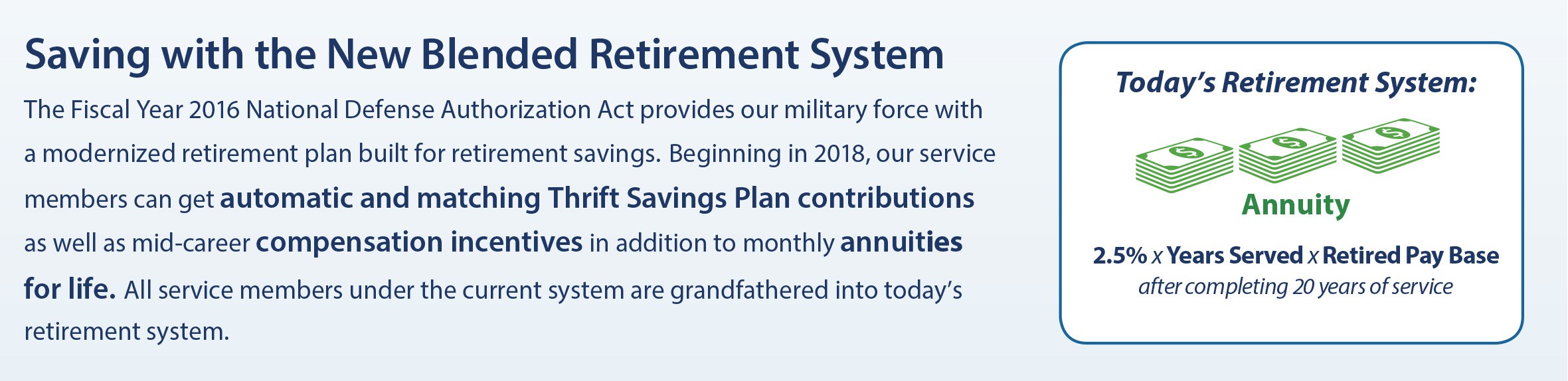

The new Blended Retirement System is the result of the Fiscal Year 2016 National Defense Authorization Act. For the first time, the Department of Defense is automatically contributing to service members' TSP accounts and instituting a program for matching contributions, according to DoD officials.

On June 1, Pentagon officials held a leaders course to educate senior DoD and military leaders on the transition to the Blended Retirement System. It was the first of a four-part series of forums on the new policy outlining key facts, such as who the new retirement plan impacts and the different levels of education that will be required in order to effectively inform service members about changes to their retirement.

"Leadership at all levels need to understand what the Blended Retirement System is and what it means to people who they supervise," said Maj. Ben Sakrisson, a Department of Defense spokesperson.

"We want them to be able to talk about the facts of the policy and the facts of life long financial preparedness, financial readiness, investments, compounded interests and all the other information that needs to be parceled with this policy change to make sure our force understands the true impact of what they have in front of them when making this decision," said Wayne C. Boswell, director of Financial Readiness with the Pentagon's Office of the Deputy Assistant Secretary of Defense, Force Education and Training.

A significant focus is on active duty service members who will have less than 12 years of service (and reservists with less than 4,320 retirement points) as of December 31, 2017, who will be able to opt into the Blended Retirement System. It's estimated that approximately 85 percent of people who leave the military would receive some form of retirement benefit under the new retirement plan.

"Now [service members] have the opportunity to leave the military with self-investments, skills, experience and education--but resources that they've set aside for themselves to help them with their life long financial goals," Boswell said. "This is leveraging the TSP capability--a very good retirement system that our service members have access to."

The Thrift Savings Plan provides service members an opportunity to "leave with self-investment before the 20 year mark," Boswell added.

But there is change to the military retirement annuity: Under the new plan those who retire at 20 years would see their retirement multiplier reduced from 2.5 percent to 2 percent times the average of their highest 36 months of basic pay.

"We don't take a position on what [retirement option] is better for a person--it's a personal decision," Corso said.

"Everyone's life long career plans and financial plans are different," Boswell said. "I think forcing a younger population to look at that and make those decisions is a good thing."

Retirement planning concerns

The details of the new plan have already been sent to what Pentagon officials label as "financial installation cadre": Installation financial managers and counselors, military banks and credit unions.

JBM-HH Army Community Service Financial Counselor Jin Lim and Marine Corps Personal Financial Management Program Counselor Jim Murphy, both who received specifics about the new policy in advance, agreed that there is still a considerable population of service members who are financially illiterate and have yet to make a retirement plan a priority.

"Eight out of 10 service members who I talk to don't fully understand a Thrift Savings Plan--even if they're participating--there's not enough [specific] training and education," said Lim, who provides budget counseling to Army personnel stationed on the Fort Myer portion of the joint base.

Murphy agreed, and pointed out that more specific details are needed about the DoD's plan to educate service members about the Blended Retirement System.

"The real question is, 'When is the first time a Soldier, Sailor, Marine and Airman will be taught how the Blended Retirement System (BRS) works?' When will the trainers be trained? And what is the command's responsibility to ensure the service member understands it?'" said Murphy.

"There's still a cultural indifference to contemplate retirement planning among some service members."

Still, the new retirement system has its benefits that service members should be aware of, especially those who choose not to stay in the military for a full 20 years, said Lim.

As part of the Pentagon's digital media strategy, a non-CAC enabled webpage containing a training course on the Blended Retirement System is currently available to help service members, unit leaders and family members learn more. The course is located at: http://go.usa.gov/chPDB.

The course can also be accessed through Military OneSource at: www.militaryonesource.mil.

The online course and tutorial are designed to inform users to better understand and compare what personalized military retirement and savings option would work best for them. Moreover, a myriad of different scenarios featuring four relatable individuals, with varying years of service and skill sets, allows military personnel to gain insight into how the Blended Retirement System works.

A trainer-to-trainer course is currently being developed and will be available in September, Boswell said. A more personalized course which will feature a retirement benefits calculator--primarily focused on those considering opting into the new retirement system--will be available in January 2017, officials said.

Social Sharing