FORT JACKSON, S.C. (March 6, 2014) -- Never share your banking information with a stranger from Cameroon.

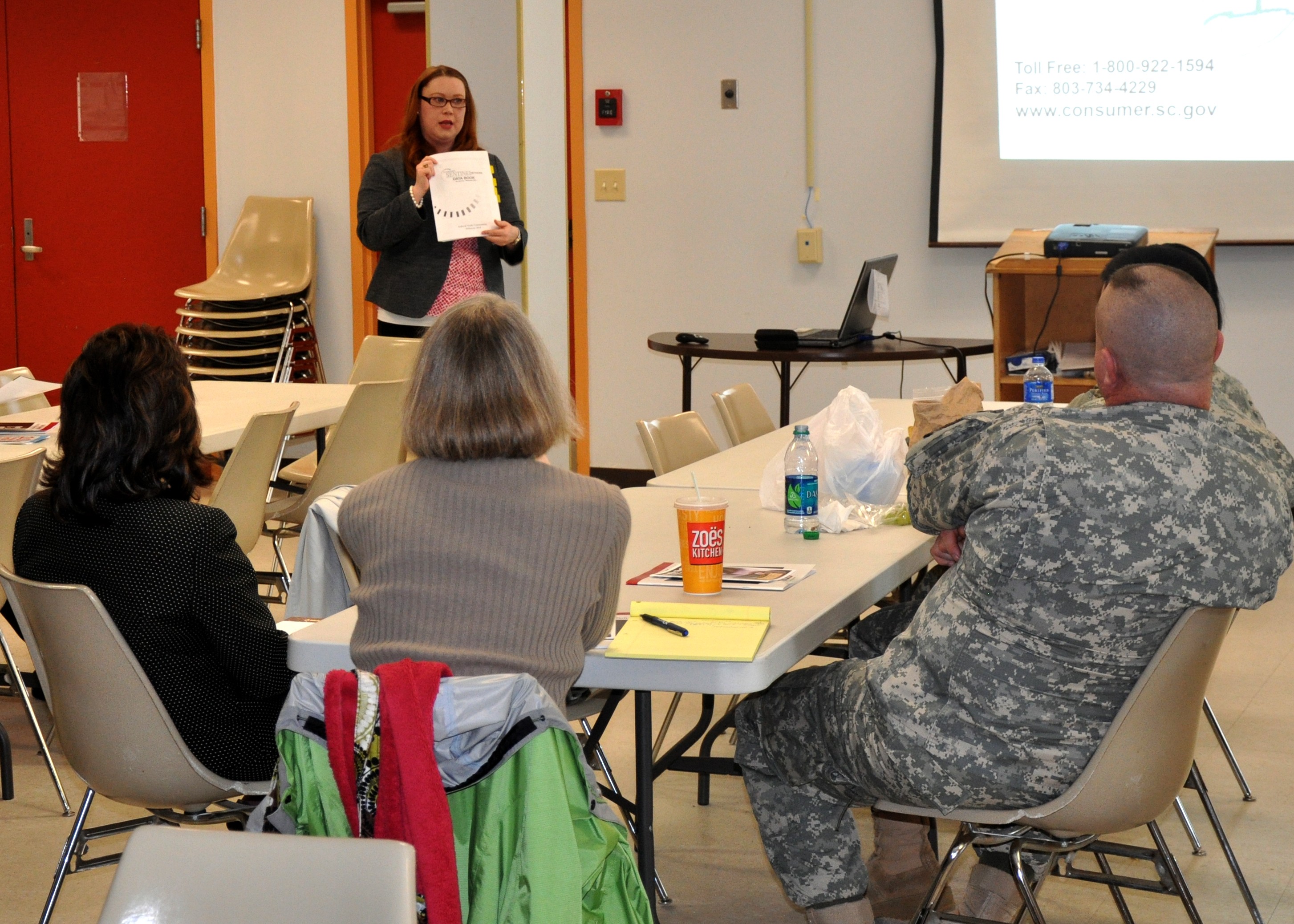

That was one of the many morals to the stories shared March 3 at an identity theft seminar conducted at the Main Post Chapel. Common sense is the best safe guard against becoming a victim, advised Marti Phillips, director of the South Carolina Department of Consumer Affairs' Identity Theft Unit. But technological advances have allowed thieves the opportunity to strike whenever any financial transaction takes place, she said.

"How does it happen" she asked. "Pretty much any way you can imagine. You can unknowingly provide your information. Your friends and family can, either knowingly or unknowingly, provide your information. You can lose your wallet or leave receipts lying around. People can divert your bills by using your address. Dishonorable employees can also take your information ..."

It's common for identity theft to be used to obtain utilities or to commit credit card fraud. Most often in South Carolina, though, identity theft is used to obtain government documents or to commit benefits fraud.

"That's surprising to people," she said. "They don't really get it until they go to apply for these benefits themselves and are denied because somebody has used their information."

This information can also be used to evade background checks or to gain licensing, she said.

"Don't disclose (personal) information online, over the telephone or through the mail," she said. "Be cautious when you're shopping online, and don't carry things (like) your Social Security card, birth certificate or all of your credit cards."

Data breaches often put personal information in danger, as do door-to-door scams, Phillips said. The Internet also helps to facilitate theft, as do "skimmers" used at teller machines and gasoline pumps.

"While we were Googling images of skimmers, websites popped up where you could buy them," she said during the presentation. "It's not hard to find them."

Skimmers are key pads and card readers that are placed over machines used to read credit and debit cards. They record key strokes and card information, which can be used later without your involvement.

"It's a little more obvious on an ATM, because the device goes over (the place) where you would slide your card," she said. "At gas pumps, it's a little more difficult to spot because they go inside the device. They can also be tiny, hand-held devices."

Phillips said the South Carolina Department of Consumer Affairs once processed a complaint about a company that pushed "free" magazine subscriptions. The first few issues were free, she said, after which customers started to be billed. By the time the bills came due, people had forgotten about agreeing to the purchase, or simply failed to notice them because the charges were so small.

"We got a hold of the company's manual," she said, "and they had studied how much they could charge people before they started to question them. Anything under $15, most people wouldn't notice or question. They know what they're doing."

South Carolina ranked 17th in the nation for identity theft complaints in 2012, up from 36th in 2005. More than 3,300 identity theft complaints were made last year, she said.

The South Carolina Department of Consumer Affairs gets between 5,000 and 6,000 consumer complaints each year, she said, and recently launched an online complaint system. The Identity Theft Unit opened last July.

"In the last couple of months, we're (receiving) more identity theft calls than we have previously," she said. "I think a lot of this is awareness. People are just more aware that they can call us."

The department maintains a "scam database" that helps with investigations, though it's not foolproof.

"If you call us and report it, we enter it in there, but we can't always do anything about it," she said. "If we don't know, we're good at trying to find you the right person (to help)."

For an explanation of how to file a fraud alert, contact the Federal Trade Commission at 1-877-382-4357, or visit them online at http://ftc.gov.

"If you file a complaint with the FTC, it's going to create something called the Identity Theft Affidavit," she said. "Some companies are going to require a copy of that if you're trying to close an account. It also has (legal) significance because to block information that results from identity theft (from) your credit report you have to have that tool."

If you're a victim of identity theft, contact credit reporting agencies and place fraud alerts on credit reports, which is a free service. Also, consider placing a credit/security freeze on your accounts, which prohibits credit reporting agencies from releasing a consumer's credit report or score without their authorization.

If you have questions about identity theft or think you might be a victim, contact South Carolina's Identity Theft Unit at 1-800-922-1594, or visit them online at www.consumer.sc.gov.

Related Links:

South Carolina Department of Consumer Affairs, Identity Theft Unit

Social Sharing