FORT RUCKER, Ala. (July 11, 2013) -- It's important for people on Fort Rucker to be certain about how they manage their finances, especially in uncertain fiscal times, and Fort Rucker has the resources to help Soldiers and Families.

"Our mission is to get Soldiers, their Families, civilians and retirees to focus on improving their personal finances and making informed decisions on how to get their money to work for them -- not against them," said Mike Kozlowski, personal financial readiness specialist for Army Community Service. "Money impacts our lives in some way every day, ranging from making a decision on where to go for lunch to paying our bills."

ACS offers financial readiness training, which is an eight-hour program that is mandatory for first-term Soldiers ranking from private to specialist or corporal, and must be completed within 60 days of in-processing. Soldiers sometimes have trouble fulfilling this requirement in a timely manner, said Mike Burden, financial readiness program manager.

"We don't exactly have the easiest time marketing the class to Soldiers," said Burden, adding that incoming Soldiers are not the only Fort Rucker residents eligible to enroll in this class.

"Since 'repetition is the mother of all learning,' all Soldiers who feel the need to reacquaint themselves with the basics of personal financial management should attend this class," said Kozlowski.

Classes are normally presented the first Friday of each month -- except on holidays -- from 7:30 a.m. to 4 p.m. in Bldg. 5700, Rm. 284; the next class will be held Aug. 2. For more information on financial readiness training, call 255-9631 or 255-2594.

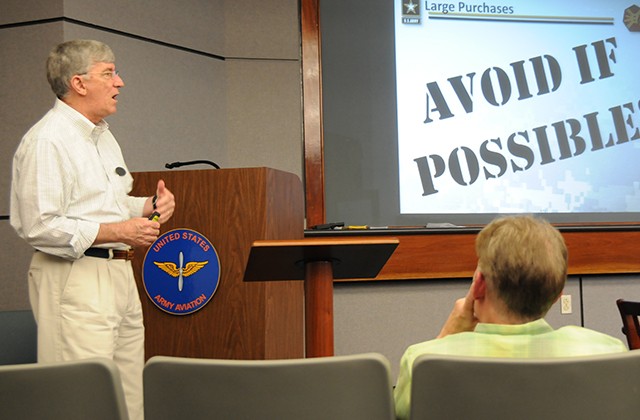

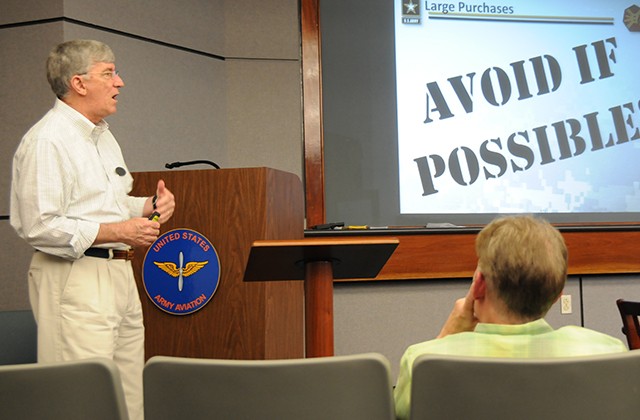

ACS also conducts furlough seminars in order to help civil service employees that have been affected by the recent furlough by providing advice on how to manage their finances.

"We're trying to provide some financial education information to civil service employees that are interested in getting ahead on the financial end of the furlough," he said. "We decided to pool our financial resources here -- our experience and knowledge -- and come up with a presentation that was focused on ways that individuals could reduce expenses temporarily."

Although the seminars are meant to educate people about financial responsibility during the furlough, Burden said these are lessons that they should apply year round.

"This (training) isn't just about the furlough, it's something that people should always be looking at," he said. "It's not just about reducing expenses and looking at your financial goals, but it's to get people to look at their expenses year round."

The seminars focus on temporary changes because the current furlough will only last through the end of the fiscal year, said Burden. They will start by doing a cash-flow analysis to get an overview of the individual's financial situation.

"In order for most people to get an idea of how much they need to reduce in their expenses, they need to know how much income they have coming in, and the cash-flow analysis will help see that," he said. "We find that a lot of people don't really know how much money they have coming in."

Burden said that although people know what their income may be, actually seeing all of their income on paper, along with their expenses, gives them a broader view of where their money is going and where they can cut.

People start by getting their leave and earnings statement, which is like a detailed pay stub that shows all income, deductions and allotments, said the financial counselor.

"We ask the participants to look at their LES and look at their cash-flow analysis because it's too much information to keep track of in their head," he said. "We also ask people to list all their monthly expenses, including fixed expenses like mortgages, rent and auto expenses; and flex expenses, which include things like food, groceries and gas."

Burden said that one place that a lot of people will be surprised that they spend is in their miscellaneous expenses, which include things like coffee, snacks or cigarettes, and offers advice to help keep track of how much they are spending on those miscellaneous expenses.

Burden said that if individuals are faced with furloughs, people might need to adjust their financial goals, but only temporarily. Along with putting their goals on hold, people will most likely be faced with having to cut expenses.

"That's something that we talk about and people can do it pretty easily if they really want to," he said. "It's a behavior modification -- more of a mindset than anything. It's like losing weight. You've really got to get your mind around it first and accept the fact that you want to reduce your expenses."

People should think long and hard about making a decision that would affect them in the long-term, he said.

The next furlough seminars will be held July 16-17 from 11 a.m. to noon, 3-4 p.m. in Bldg. 5700, Rm. 282.

For more information , call 255-9631 or 255-2594.

Related Links:

USAACE and Fort Rucker on Twitter

Social Sharing