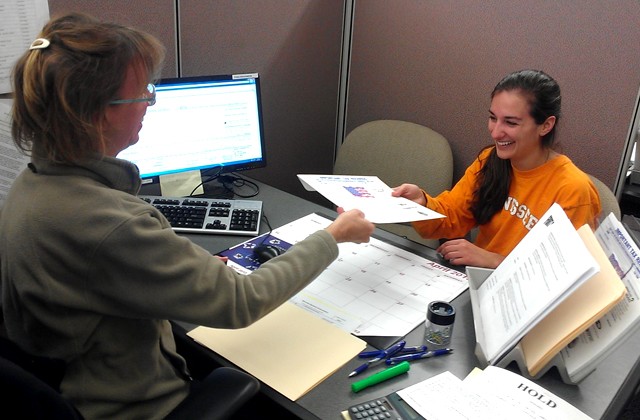

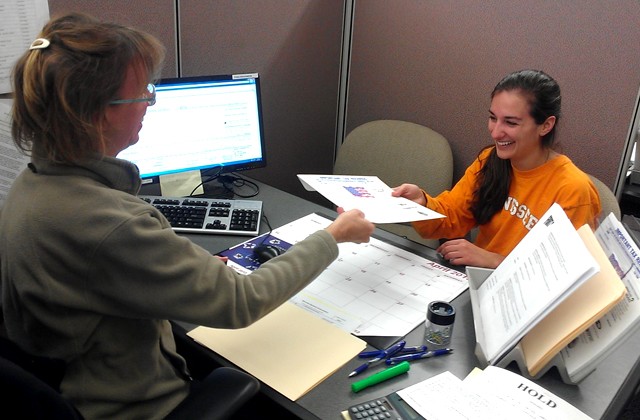

FORT RUCKER, Ala. (April 11, 2013) -- As tax season comes to an end, the Fort Rucker Tax Assistance Center helped about 1,200 people and saved the military community more than $248,098 in federal and state income tax preparation fees.

"We saw more people this year and so far we received Federal and State refunds in excess of $2,482,608," according to Tod Clayton, tax coordinator at the center.

The center will continue to see people until April 15, and one last-minute patron appreciated the opportunity to be seen.

"It was readily and easily available. I liked it and I will definitely use [it] again," said 1st Lt. Frank Gamsby, D Company, 1st Battalion, 145th Aviation Regiment.

Though Gamsby did not have any difficulties filing, many Soldiers did this year. And many dealt with the same problems, according to Clayton. But, they were able to educate Soldiers and their Families and get everything worked out in the end.

"We saw a problem of Soldiers not withholding enough, so they actually had a balance due. And, because of Congress, a lot of refunds took more time to be distributed," he said.

Another problem that the tax coordinator said they encountered this year is problems with Social Security Cards.

"Now is the time to start planning to get a card if you do not have one, and we require you to have one to use our services," he said. "Make sure your name matches the numbers. People forget that they got married or divorced and didn't change their names," he said.

Though tax season is wrapping up, Clayton said that people should think about their taxes all year long.

"People need to look at their wages and their withholdings and make sure they have at least 10 percent taken out. That is about the average rate, you can be pretty safe calculating that way," he said.

People also need to be aware of major life changes and how it affects taxes.

"If you get married then you may want to change your withholdings from single to married. It is also really important for Soldiers who get a divorce or for spouses that are separating and will file separate to change their withholdings as well," he said. "If you get a divorce on Dec. 30, then you are considered single for that tax season."

This day and age a lot of things are done online and taxes are no different, according to Clayton.

"Soldiers do have access to changing withholdings on their W-2s electronically. You should have an equal amount of withholdings if you are making a decent amount of wages," he said.

In preparation for next season, Clayton said that people need to make sure they organize all of their W-2 forms, their interest rates and dividends, and all their other tax documents.

"Set a folder aside and when you buy something this year, such as a car that you paid taxes on, put it in there with your tax statements and all your deductions that you acquire throughout the year, such as a donation to a charity," he said.

"Plan throughout the year, not everyone thinks about taxes when it matters, they think about it at the end when it is too late," he added.

Some people like large payouts during tax season because they are not the best savers or organizers, but Clayton suggests that those people review their taxes so they have more money in their pocket during the year.

"When we give a refund to someone who is getting back, say $10,000, that is almost $1,000 a month that you could have had in the bank making interest instead of giving the government a free loan," he said.

For Soldiers and Family members who may not be on the top of things, they can request up to a six month extension to file their income tax return by using IRS Form 4868, according to Clayton.

"This is not an extension to pay taxes due, only to file your taxes. You may be subject to additional interest and penalties for not paying by the deadline," he said.

Clayton does taxes year round and if someone realizes a mistake was made he advises to not wait until next season to fix it.

"Come back in if there is a problem. Now is the time to handle amendments to your return," he said.

Social Sharing