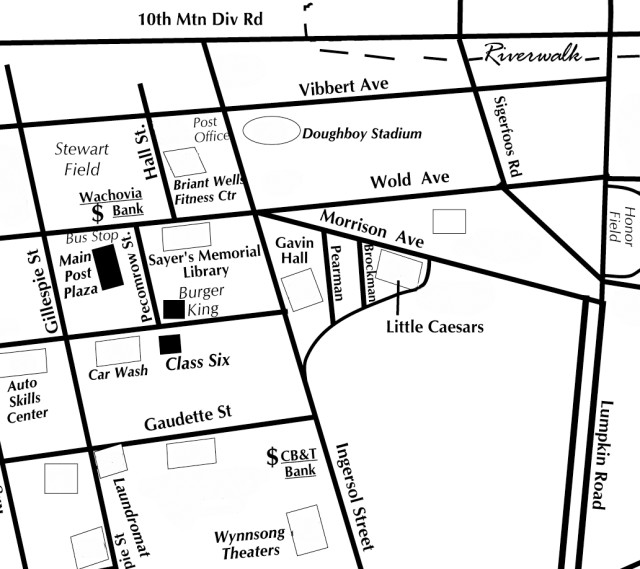

FORT BENNING, GA- The Fort Benning Tax Center will hold a ribbon-cutting ceremony at 10 a.m. Wednesday in its new building, Building 328 on Ingersoll, to kick off the 2010 tax season.

Tax attorney CPT Caitlin Chiaramonte said the Tax Center helped more than 6,000 people last year, which equated to more than $610,000 in saved preparation fees.

Soldiers at the Tax Center have trained since November and are prepared for the season, Chiaramonte said.

"We have a knowledgeable and dedicated staff," she said. "They have all been Volunteer Income Tax Assistance-certified by the IRS for all types of returns, and they are all briefed on current tax law."

The service is free, but for those who choose go off post, Chiaramonte cautioned against preparers that are only open during tax season or do rapid refund loans.

"A lot of them promise you a high refund, but they also have high fees," she said. "But if your taxes are done legitimately, your refund will be the same."

In addition to military identification cards and Social Security cards for the filer and family members, patrons should bring in any pertinent documents they want accounted for on the return.

What should you bring'

Free tax preparation will begin Thursday for retirees and Jan. 25 for active-duty Soldiers, retirees and eligible family members. Patrons are also encouraged to bring two copies of all documents to help reduce wait time:

Property tax receipts

Receipts for charitable contributions

Home mortgage interest statement

Power of attorney (if necessary

Student loan interest statement

Interest statement (1099 INT)

Prior year federal and state tax return

Divorce decree if applicable

Proof of child care expenses or educational expenses

IRA/TSP contribution statement

HUD 1 statement (if purchased home in 2009)

Stimulus payment statement

Educator expenses

New car purchase sales documents

Statements reflecting capital gains/loss dividend income statement (1099 DIV)

Bank information with routing and account number (voided check preferred)

Get help from the IRS

The Internal Revenue Service publishes the Armed Forces Tax Guide or Publication 3 to address points of interest for service members. It can be found online at www.irs.gov/publications/p3/index.html or by calling 800-829-3676.

Topics addressed include:

First-time homebuyer credit - Special benefits for members of the military and certain other federal employees serving outside the United States.

Economic stimulus payments- Information on the economic stimulus payments for members of the military serving in a combat zone.

Questions and answers on combat zone tax provisions

Source: www.irs.gov

Social Sharing