ABERDEEN PROVING GROUND, Md. - Aberdeen Proving Ground civilians received tips on protecting their identifications and repairing credit during an Identity Theft financial seminar at the Mallette Conference Center March 20.

Keosha Pointer, a human resources specialist with the U.S. Army Communications-Electronics Command and Army Wellness Center coordinator hosted the event.

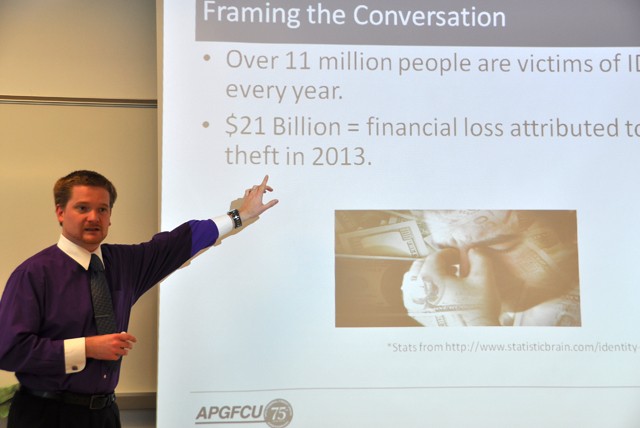

Michael Ches, a financial education advisor with the APG Federal Credit Union reviewed ways to reduce the threat of identity theft, monitor credit ratings, recognize when a theft has taken place, and understand the plan of response.

Ches demonstrated the need to reduce the amount of personally identifiable information people normally carry in their wallets and handbags by leading a Theft ID Bingo game in which players received points for each item in their wallets containing their name, address, phone number, spouses' name, social security number, birth date, credit cards, insurance information and other personal information.

"The goal is to get you thinking how much personal information you carry around with you all the time," Ches said, "so you'll understand the need to limit what you carry on your person."

"There's not a lot identity thieves can do with just your name, but you add all that other information and they've got you."

He said that obtaining a credit report every year is crucial to monitoring credit ratings and recommended using www.annualcreditreport.com to gain credit ratings from the "Big 3": EQUIFAX, Experian and TransUnion.

"A lot of things other credit services advertise as free really are not," he said.

Ches focused on the perils of social media, cautioning listeners that sharing too much information on Facebook, for example, like revealing their address through photos of their house and sharing vacation plans, can increase their risk. He said that statistics show that those closest to them are the ones most likely to misuse their identity. In the event of suspected ID theft, victims should immediately close their accounts, file a police report and report the incident to the Fair Trade Commission he said.

Ches distributed a pamphlet containing information about credit reports, dealing with debt, avoiding scams, and more identity theft prevention and response tips. He encouraged listeners to challenge any negative or unfamiliar entries on their credit reports.

He said the class is one of several in an outreach program coordinated through AWC and offered free of charge to APG organizations. Feedback from the seminars is always positive, he said.

"This is one of the ways we give back to the community."

Attendees said they appreciated the lunch hour event.

"I came here to learn about the social media aspect and I learned a lot," said Robert Blackwell, a CECOM inventory management specialist.

A CERDEC computer engineer and team lead, Matthew Cannon, said he was one of thousands notified about the TARGET department store data breach. Though he wasn't targeted he did sign up for free credit monitoring.

"I came because I was curious to learn more," he said. "I did learn something new. I don't use social media a lot but it's important to be cognizant [of the risks]."

Dan Singh, a retired chief warrant officer, said he learned about the seminar through his wife, Sue Singh, a Kirk U.S. Army Health Clinic nurse.

"I learned a lot of new stuff that I can apply and share," he said. "I'm retired now and spending time with my grandkids but I've got my life savings and you can never be too careful."

Check the APG News "Mark Your Calendar" page and APG social media sites for future financial seminars.

Social Sharing