When markets are volatile, many long-term investors -- those saving in the TSP, 401Ks and IRAs -- are sometimes tempted to "time the market." What does that mean? To sell before markets drop, and re-enter (buy back in) before markets recover.

The question these people ask themselves is: "What's the best day to sell, and what's the best day to buy back in?" Some historical examples show us that this is a bad habit.

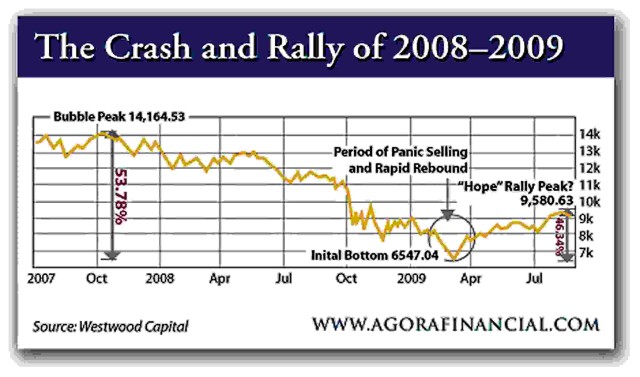

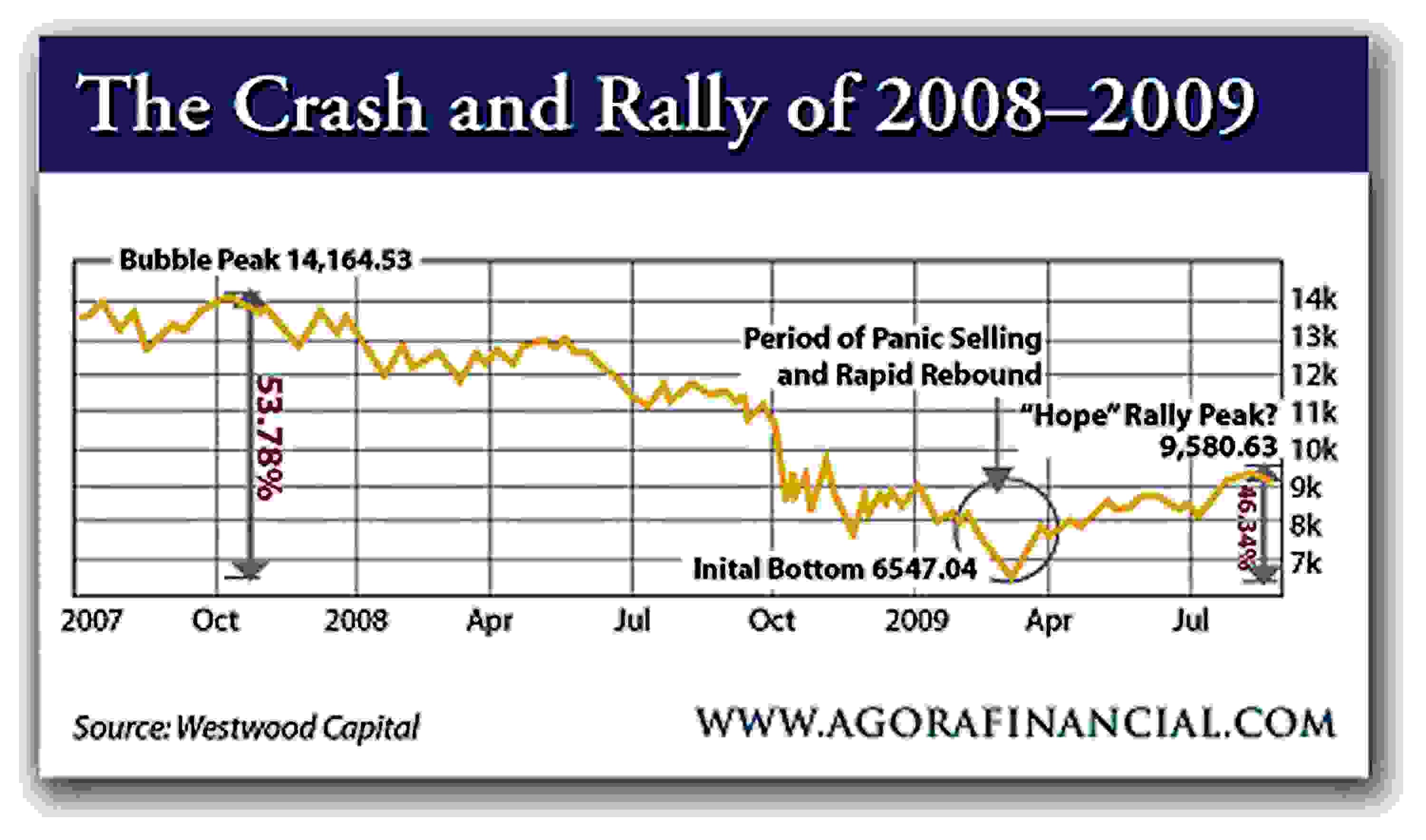

Within one month, October, 1987, investors lost an average 23 percent of their net worth. From 2000 to 2002, investors in the dot-com sector lost 78 percent. In one day, September 11, 2001 the average investor lost 7 percent of her net worth. In the fifteen months following October 2007, U.S. stock market investors lost an average 50 percent of their nest egg.

It?'s certain that we?'ll experience more market devaluations before we retire. The GOOD NEWS is that following EACH of these downturns, markets have recovered quickly and investors who maintained their strategy and positions quickly recovered their paper losses.

Following the September 2008 collapse of financial markets, the Dow gained 2,200 points from March 9 through June 5, 2009. Many market-timers who exited the market did not benefit from this rally since they did not re-enter the market ahead of it. The double whammy incurred by market timers, is that many convert from stocks to cash after the market has begun to tumble (selling low) and then re-enter after the market has begun to recover (buying high). Valuations, moving averages, and yields can predict the direction of the market; however these are not exclusive rules so you wouldn't want to bet your retirement on them.

The truth is that consumers who maintain a stable investment strategy based upon their individual investing time horizon generate better results than average consumers who try to time the market. There are numerous tools available online from trusted sources that are designed to assist consumers in developing and maintaining a balanced portfolio, optimal for long-term investment growth. These sites include money.msn.com; www.google.com/finance; www.thestreet.com; www.bankrate.com; and there are many others.

Listed below are some tried and true steps to building and maintain a retirement portfolio:

1. Adjust your portfolio based on your age. The classic balanced portfolio suggests 60 percent in stocks, 30 percent bonds, and 10 percent cash or money market funds. If you're younger, you can increase your stock holdings.

2. Calculate your expected sources of retirement income, other than what you'll get from your investments. Knowing this number helps you determine how much total money you'll need to save for retirement.

3. Calculate your anticipated retirement allowance, based on the growth you can expect from your investments. If you're not sure how to calculate what stocks, mutual funds and other non-fixed income investments will earn, use past growth reports to arrive at an estimate. Add your savings to your other expected retirement income sources, then divide by the number of years you expect to be retired.

4. Reallocate your portfolio based on your risk tolerance. If the annual allowance you calculated (in item 3 above) doesn't look like enough, you have two options: invest more aggressively, or save a higher percentage of your income.

5. Invest your money wisely by choosing relatively low-risk forms of each investment type for your portfolio. To mitigate risk from holding bonds, stick with investments with maturities of three years or less, and choose reliable bonds unlikely to default, such as U.S. Treasuries or reputable corporate bonds. Pick stocks that pay out dividends, since these investments tend to be less volatile.

6. Evaluate your retirement portfolio's fund distribution at least once annually, and make adjustments as you age. Scale back your stock holdings as you near retirement, and consider using a portion of your savings to buy a life annuity, which will guarantee you a specific income for the rest of your retirement years.

Please contact the POC, Mr. Richard Zimmelman, USAG-Miami Financial Readiness Program Manager with any questions: email Richard.C.Zimmelman.Civ@mail.mil; phone: (305) 437-2645.

Social Sharing